EUR/GBP Analysis:

- EURO trading at highest level vs Sterling since June

- ECB set to monitor Euro strength and any adverse effect on inflation

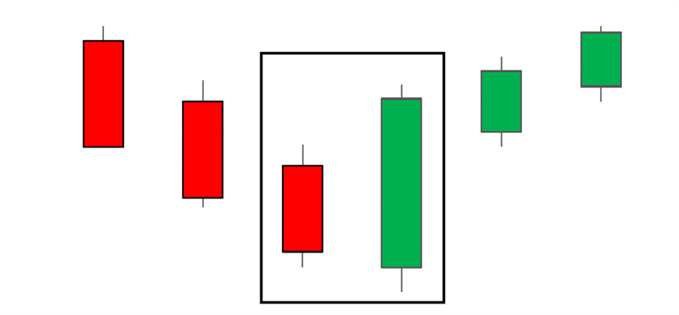

- Bullish engulfing pattern validated with extended bullish move

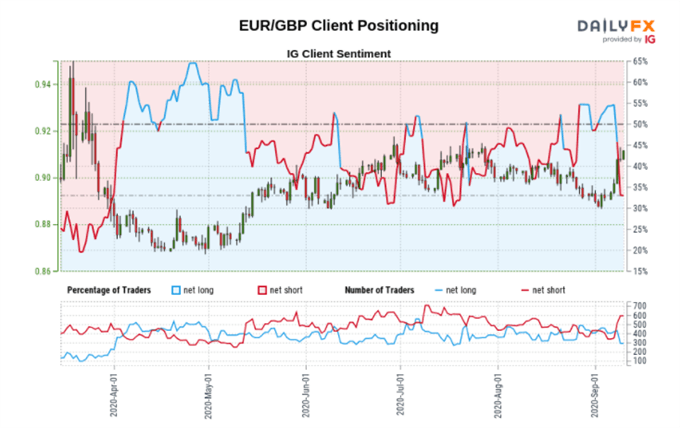

- IG Client Sentiment bullish, despite the majority of traders remaining short

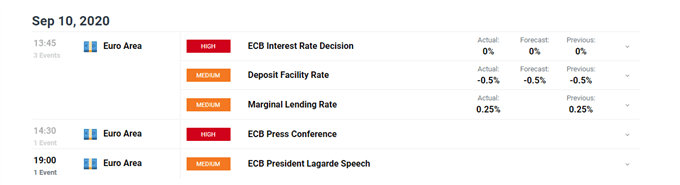

The European Central Bank (ECB) has decided to maintain the current interest rate as the Eurozone rebound is largely in line with ECB expectations despite uncertainty around the strength of the economic recovery.

ECB President, Christine Legarde, mentioned that there is no need to overreact to the appreciation of the euro and clarified that the central bank does not target the FX rate. This was in response to concerns that have arisen around potential adverse implications of a stronger Euro on future inflation.

Visit the DailyFX Educational Center to discover why news events are Key to Forex Fundamental Analysis

DailyFX Economic Calendar

For all market-moving data releases and events see the DailyFX Economic Calendar

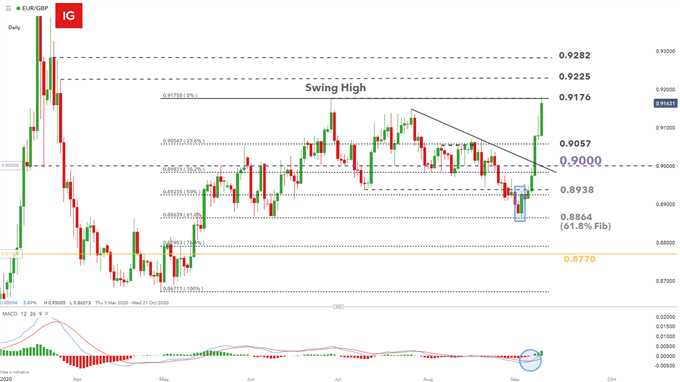

Bullish Engulfing Provides Platform for Extended EUR/GBP Bull Run

The EUR/GBP pair has printed a remarkable bullish continuation, fueled further by emergency Brexit talks on Thursday between European Commission Vice-President Maros Sefcovic and UK Cabinet Office minister Michael Gove regarding the proposal of a UK law that would override sections of the Brexit withdrawal agreement signed by both parties in January – See full report here.

After witnessing the bullish engulfing pattern and bullish MACD crossover, price accelerated and broke trendline resistance with ease, providing a possible change in near term momentum. The renewed upward momentum had recently breached the recent swing high at 0.9176 with the next level of resistance at 0.9225, followed by 0.9282.

However, should price fail to break and close above 0.9176, this could represent a zone of resistance and open the door to a near term retracement of the accelerated bullish move. A lower move would see the 23.6% Fib level (drawn from the April low to June high) come into focus at 0.9057 before the psychological number 0.9000 becomes the next level of support.

EUR/GBP Daily Chart: Bullish Engulfing and MACD Crossover Setup

Chart prepared by Richard Snow, IG

Learn How to Identify and Apply the Bullish Engulfing Pattern

IG Client Sentiment bullish, despite the majority of traders remaining short

Current Trader Positioning:

- EUR/GBP: Retail trader data shows 33.86% of traders are net-long with the ratio of traders short to long at 1.95 to 1.

- The number of traders net-long is 16.49% lower than yesterday and 34.41% lower from last week, while the number of traders net-short is 15.09% higher than yesterday and 54.77% higher from last week.

Interpretation:

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/GBP prices may continue to rise.

- Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes hints at a stronger EUR/GBP-bullish contrarian trading bias.

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX