Crude Oil Price Analysis & News

- Oil Outlook is Challenging on Demand Concerns

- OPEC Meeting to Garner Attention

Oil Outlook is Challenging on Demand Concerns

Despite the bounce back in crude oil prices in yesterday’s session, which had largely stemmed from the recovery in risk sentiment. The outlook remains challenging for crude oil prices as stalling demand becomes an increasing concern. In recent sessions, Saudi Arabia had lowered their official selling price for oil in order to support demand for its crude. This also comes at a time that Chinese demand has eased highlighted by a 7.4% drop in crude oil imports in August.

OPEC Meeting to Garner Attention

On top of that, oil supply has picked up as OPEC+ have continued to ease production cuts as planned, whereby production has increased by as much as 1.5mbpd since June. In turn, as Brent crude futures meander around the $40/bbl mark, continued to selling may see OPEC+ look to enact deeper production cuts. As a reminder, the OPEC+ JMMC is scheduled to meet on September 17th, as such, OPEC noise will likely increase in the run up to the meeting, thus heightening headline risk for the oil complex.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | 1% |

| Weekly | 31% | -38% | 7% |

Overnight, the latest API crude oil inventory report showed a surprise build of nearly 3mln barrels, against expectations of a 2.3mln drawdown, which has kept a lid on the price rise in the energy complex.

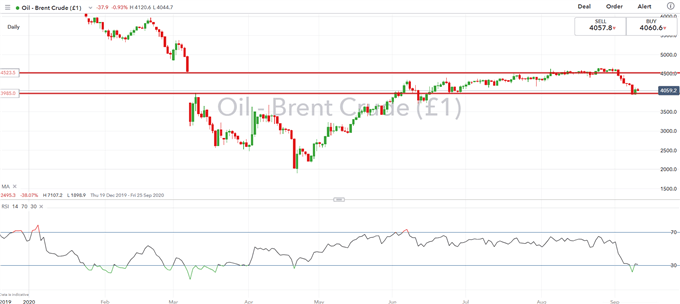

Brent Crude Price Chart: Daily Time Frame

Source: IG