Nasdaq 100 Price Outlook:

- The Nasdaq 100 suffered its worst 3-day period since March as technology stocks unraveled

- With only minor weakness in other risk assets, has the worst of the technology rout passed?

- Nasdaq 100, DAX 30, CAC 40 & Nikkei 225 Forecasts for the Week Ahead

Nasdaq 100 Price Forecast: Is the Technology Rout Over?

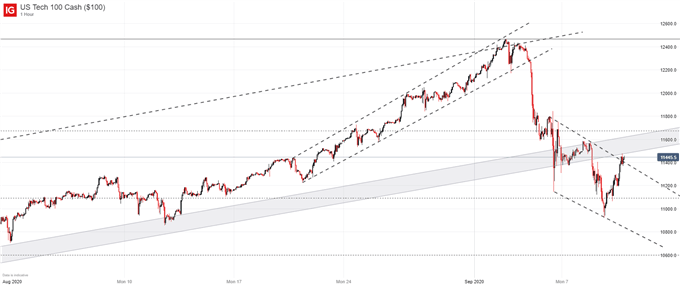

The Nasdaq 100 is in the midst of a volatile trading week as technology stocks look to recover from earlier weakness after the index suffered its worst three day decline since March. Slipping from record highs around 12,500, the Nasdaq 100 quickly unraveled to slide from the topside of an ascending channel to test the lower bound before eventually breaking beneath. As a result, a technical blow has been dealt to the tech-heavy index despite few changes in the fundamental landscape.

Nasdaq 100 Price Chart: 1 - Hour Time Frame (August 2020 – September 2020)

Thus, I am hesitant to suggest the Nasdaq is entirely out of the woods just yet. While the origin of the selling has been discussed at length, it is difficult to attribute the reversal to a single theme as very few notable fundamental developments have occurred since declines began. With that in mind, I would argue the technical breach is the most significant development for the Nasdaq and could allow for further weakness in the days to come.

A Guide to Support and Resistance Trading

That said, traders can look to utilize technical barriers near the current trading price to navigate price action on the shorter time frames. An ascending trendline, Fibonacci level and psychological markers all reside slightly above the Nasdaq at the time of publication, each of which could work to keep recovery rallies in check. On the other hand, possible support resides around the 11,080 mark and near Tuesday’s swing low at 10,940.

Either way, an abrupt reversal lacking a clear-cut catalyst is a concerning development for US equities and is a perfect example of the uptick in volatility that is often observed in September and October.

While weakness may not persist indefinitely and the current climate may not lead to a bear market or severe stock market crash, volatility has undoubtedly returned and with the technical break, further volatility could lead to further losses. Encouragingly, weakness in the technology sector has been relatively targeted, so other risk assets like the Australian Dollar and European equity markets have been somewhat insulated from recent turbulence.

Nevertheless , a recent break down in crude oil prices could hint that broader risk aversion is in the cards. Still, further evidence of a larger pullback in risk assets is needed to confirm a swing in market sentiment. All in all, there is little to suggest weakness in the technology sector has concluded and volatility looks poised to continue in the weeks leading up to the US Presidential election. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX