EUR/USD Price, News and Analysis:

- EUR/USD bounces off 50-dma with another attempt expected soon.

- Thursday’s ECB meeting and press conference key to EURUSD direction.

DailyFX Economic Data and Events Calendar

Thursday’s ECB policy meeting and press conference will likely play an important role in the future direction of the single currency although it may be talk rather than action that sets the tone. The central bank is expected to leave all policy levers untouched but they may indicate that they are unhappy with the current level of the Euro which is dampening price pressures in the single-block. Recent comments from ECB chief economist Philip Lane that the EUR/USD rate ‘does matter’ has seemingly drawn a 1.2000 line in the sand for the pair and this topside is likely to be respected by the market for now.

ECB President Christine Lagarde is likely to highlight that Euro strength is weighing on both growth and inflation outlooks and that the central bank is uncomfortable with the current level of the single currency to a certain degree. The more forcefully President Lagarde makes these comments, the more the Euro will fall, while a less dovish stance will allow the single currency to recoup some of its recent losses.

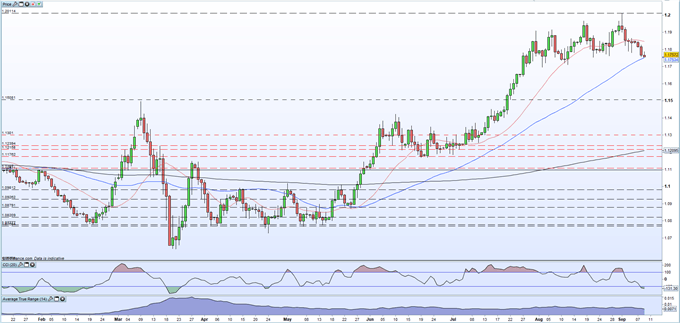

EUR/USD made a decisive break below the supportive 20-day moving average at the end of last week and is now pressing down on the 50-dma for the first time since late-May when the pair traded just below 1.0900. A break and open below the shorter-dated moving average opens the way to the 1.1696 – 1.1700 area before 1.1650 comes into play. Resistance is seen at 1.1848, off the 20-dma and a pair of short-term prior highs either side of 1.1866.

EUR/USD Daily Price Chart (January – September 9, 2020)

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

IG retail trader data shows 42.89% of traders are net-long with the ratio of traders short to long at 1.33 to 1.The number of traders net-long is 4.49% lower than yesterday and 26.39% higher from last week, while the number of traders net-short is 0.56% higher than yesterday and 7.15% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

What is your view on EUR/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.