DAX 30 Forecast:

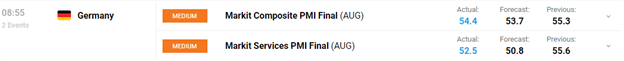

- DAX rally continues after German PMI data beats estimates

- MACD Crossover occurs above the zero-line

- Client sentiment remains bearish but rally continues

Price Action Remains in Favor of Bulls

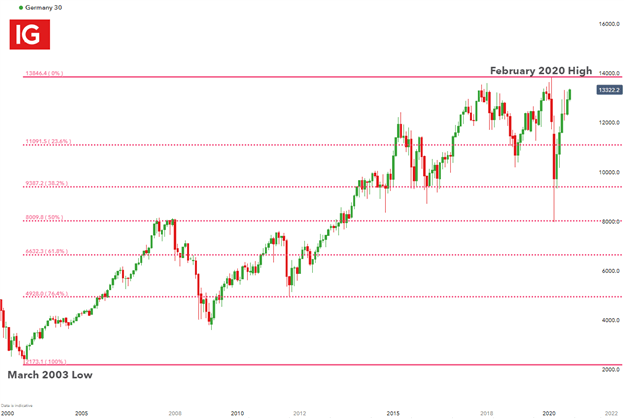

After reaching all-time highs in February 2020, the DAX 30 index plummeted, falling to a critical level of support, formed by the 50% Fibonacci retracement level of the historical move. Now, just 6 months after the Coronavirus pandemic wreaked havoc amongst equity indices, it appears as if price action is still in favor of the bulls, negating the effects of the sell-off. In this period of uncertainty, Germany PMI figures beat initial expectations, driving price action amid renewed hopes of an economic recovery.

Visit the DailyFX Educational Center to explore the basics of Technical Analysis and more

From a technical standpoint, the monthly chart below highlights how the Fibonacci retracement levels have formed clear areas of confluency, providing support and resistance for the DAX. After rebounding off of the 50% retracement level, which is also a key psychological level, a strong uptrend has persisted, eager to test December 2019 levels.

DAX Monthly Chart

Chart prepared by Tammy Da Costa, IG

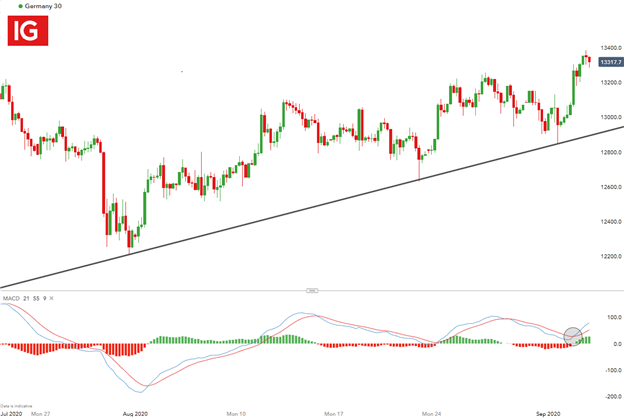

MACD Crossover – Upward Momentum may Prevail

From a short-term perspective, looking at the four-hour chart below, the Moving Average Convergence/Divergence (MACD), which measures the momentum and direction of the trend, has crossed upward, above the zero line, a possible indication that upward momentum may hold, at least in the short-term.

However, the fact that the crossover has occurred above the zero-line, suggests that the DAX may be entering into oversold territory, which may spark a correction in prices.

DAX 4 Hour Chart

Chart prepared by Tammy Da Costa, IG

DAX Setup: Key Levels

- As long as 13300 holds as support, further upside may see the next level of resistance coming into play at 13500, with January 2020 highs, being the next level of interest at 13632.

- Should the trend reverse, the 13300 and 13200 levels of support will be of particular importance

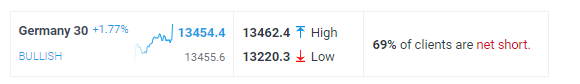

Client Sentiment

IGCS shows that, at the time of writing, client sentiment remains bearish, with 69% of retail traders holding short positions in the Dax Index. We typically take a contrarian view to crowd sentiment and the fact that clients are net short, suggests that prices may continue to rise.

--- Written by Tammy Da Costa, Market Writer for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707