USD/MXN PRICE OUTLOOK: DOLLAR-PESO SEARCHES FOR SUPPORT AS CRUDE OIL PULLS BACK

- USD/MXN price action is gyrating around its 200-day moving average

- US Dollar searches desperately for support as commodity currencies strengthen

- Mexican Peso could come under pressure if there is a resurgence of volatility

USD/MXN prices have edged steadily lower over the last couple months. This comes as the US Dollar surrenders gains notched against the Mexican Peso – and other commodity currencies like the Canadian Dollar, Norwegian Krone, or Australian Dollar – earlier this year during the onset of the coronavirus pandemic. Yet, despite weakening over 10% since March, the Dollar-Peso still trades higher by more than 15% when measured from its January opening level.

USD/MXN PRICE CHART: DAILY TIME FRAME (19 MAR TO 31 AUG 2020)

Net of these moves, spot USD/MXN price action now gravitates slightly below its 200-day moving average, which resides near the 21.900-mark. That said, after breaching this key technical level late last week, the US Dollar appears vulnerable to another leg lower against the Mexican Peso. If USD/MXN bulls can reclaim this barrier, however, it could encourage them to target the 50-day moving average or 23.6% Fibonacci retracement level outlined on the chart above. On the other hand, if the bearish medium-term trend prevails, the 08 June swing low could serve as a potential downside objective for USD/MXN bears.

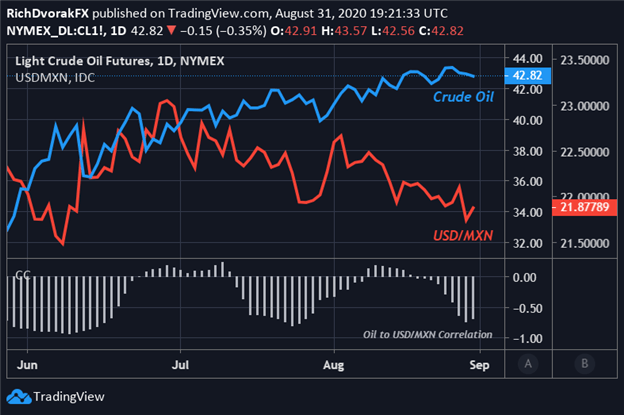

USD/MXN PRICE CHART & CRUDE OIL OVERLAID: DAILY TIME FRAME (27 MAY TO 31 AUG 2020)

Perhaps the direction of crude oil could indicate where spot USD/MXN price action heads next. The Dollar-Peso tends to holds a strong inverse relationship with crude oil price action, which is indicated by the negative correlation coefficient generally maintained. The Mexican Peso is closely tied to fluctuations in oil prices seeing that Mexico is one of the world’s largest producers and exporters of crude oil. Also, the relationship between crude oil and USD/MXN is similar to the relationship between crude oil and USD/CAD.

Correspondingly, there is potential for USD/MXN prices to continue drifting lower while the global economy sustains its recovery and crude oil advances further. This brings the release of PMIs and jobs data throughout the week into focus for a health check on underlying economic conditions. On that note, it is worth mentioning how a resurgence of market volatility and risk aversion likely stands to send USD/MXN price action snapping back higher.

Learn More: Register to Attend the DailyFX Education Summit Online for Free!

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight