DAX 30 Forecast:

- The DAX 30 is pushing the limits of its current technical pattern and could stage a break out

- That said, summer conditions may make it difficult to establish a move with conviction

- The New DAX Decade: The Past, Present and Future of the DAX 30

DAX 30 Price Outlook: German Index Ponders Technical Break Out

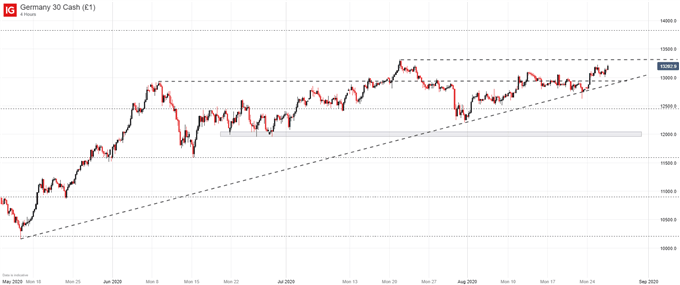

After an encouraging start to the week, the DAX 30 has rallied within reach of its July peak near 13,310. As a result, the German equity index has approached the end of its current technical pattern and could mount a break out. While the summer doldrums have worked to suppress such moves, the upcoming Jackson Hole symposium could spark the volatility required to stage such a break.

Learn all about the history of the DAX 30: The New DAX Decade: The Past, Present and Future of the DAX 30

That said, much of the potential break out rests on the upcoming commentary of the monetary policy chiefs. Coupled with the uncertainty surrounding their remarks, maintaining a position ahead of the symposium with intentions of a technical break out is a risky endeavor. Nevertheless, here are the levels to consider if you’re a trader in search of potential volatility.

DAX 30 Price Chart: 4 - Hour Time Frame (May 2020 – August 2020)

To the topside stands resistance marked by the June peak near 13,310. Since the longer-term trend of the index has been a gradual climb, I tend to favor a continuation higher at this stage. Fundamentally, this might require a doubling-down of dovish rhetoric at the symposium, while a breach above 13,310 might mean a technical confirmation of a bullish break. Even still, nothing is certain.

Top 8 Forex Trading Strategies and their Pros and Cons Including Break Out Trading!

On the other side of the equation stands a possible confluence of support. The zone is marked by an ascending trendline from May and the June swing high narrowly beneath 13,000. A move below this zone may suggest a bearish break, signaling that there could be appetite for a continuation lower.

| Change in | Longs | Shorts | OI |

| Daily | -9% | 7% | 2% |

| Weekly | -27% | 9% | -5% |

With the technical levels laid out, we can turn our focus to IG Client Sentiment data which reveals retail clients are confident the DAX will soon fall. Since we typically take a contrarian view of IGCS, this may mean that the DAX will continue its ascent in the weeks ahead.

Either way, it is important to keep in mind the broader seasonal conditions that are working against such moves. In the meantime, follow @PeterHanksFX on Twitter for further stock updates and analysis.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX