UK PMIs and GBP/USD Price, Chart and Analysis:

- UK PMIs beat expectations, business activity picks up sharply.

- One month of strong data does not make a trend.

For all economic data releases and market moving events, see the DailyFX Economic Calendar

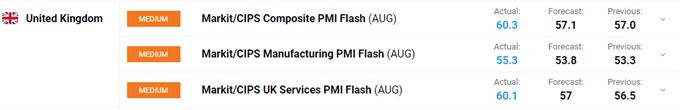

The first reading of UK PMIs for August show business activity picking up at its fastest rate since October 2013, with both the manufacturing and service sectors continuing to experience a recovery in customer demand. All three flash PMI readings beat expectations with ease.

While the release provided a positive view of the economy, data provider IHS Markit added a note of caution. Duncan Brock, group director at CIPS wrote, ‘with the fastest rise in activity in the private sector since October 2013, this shows an encouraging speed towards recovery which belies the fact that there are still some dark forces at play. Rising inflation, the sustainability of the UK economy during a global pandemic and the poor employment figures means we’re not out of the woods yet’.

How to Read a Forex Economic Calendar

Official UK data released earlier showed mixed messages for the economy. Retail sales data for July beat expectations and rose by 3.6% - forecast at 2% - compared to June and are 3.0% above pre-pandemic levels in February. According to the Office for National Statistics (ONS), ‘food and non-store retailing levels remained higher than before the pandemic, while non-food and fuel sales are still below their pre-pandemic levels’.

While retail data showed a positive pick-up in the economy, the latest public sector finance figures highlighted the ongoing cost of COVID-19 preventative measures. UK debt (PSND ex) exceeded GBP2 trillion for the first time and debt at the end of July was 100.5% of GDP, ‘an increase of 20.4% compared with the same point last year and the first time it has been above 100% since the financial year ending March 1961’.

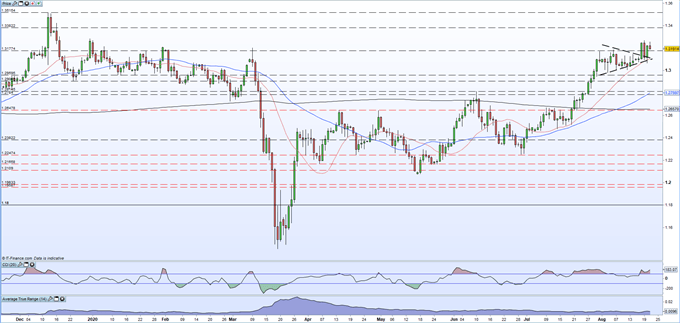

GBP/USD remains near its multi-month high despite paring back some of yesterday’s gains. The breakout from the pennant formation that I have commented on recently remains in place and the downtrend and the 20-dma offer support to the pair around 1.3090. It may be difficult for GBP/USD to make a fresh multi-month high today (1.3268), but the downside does look fairly well protected all the way down to the 1.3000 level.

Sterling traders should also be wary of any news out today from the latest EU/UK trade talks. Sterling it seems is not yet pricing in a no-deal outcome which may prove to be costly if the two sides cannot agree even a basic trade deal over the next few weeks.

Pennant Patterns – Trading Bullish and Bearish Pennants

GBP/USD Daily Price Chart (January – August 21, 2020)

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.