DOW JONES, DAX, NIKKEI 225 INDEX OUTLOOK:

- Dow Jones fell 0.29% on Thursday despite better-than-expected jobless claims data

- DAX 30 consolidated at around 13,000, a psychological resistance

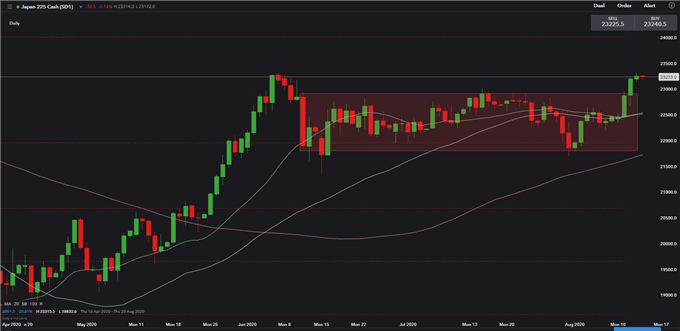

- Japan’s Nikkei 225 index broke above 22,900 resistance, attempting the next one at 23,300

Dow Jones Index Outlook:

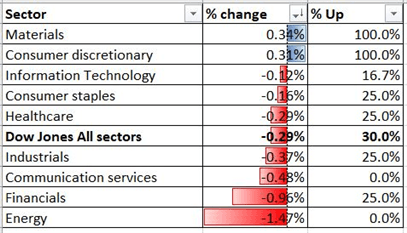

Better-than-expected US weekly jobless claims failed to lift the Wall Street equities overnight, with energy (-1.47%), financials (-0.96%), communication services (-0.43%) and industrials (-0.37%) among the worst performers. The share price of Cisco Systems plunged 11.2% after the release of disappointing 2Q results.

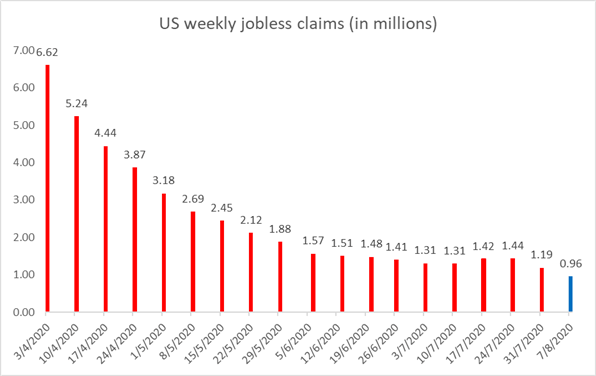

Some 963k people filed jobless claims last week, marking a second weekly decline since end July. This is also the lowest reading seen since 13th March 2020. Improving job market sentiment points to perhaps a brighter inflation outlook, which may explain rising longer-dated Treasury yields over the past two weeks.

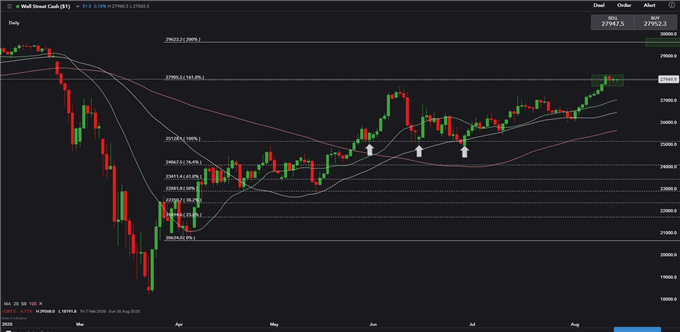

The US stock markets, however, failed to extend gains on favorable macroeconomic data, as the valuations seemed to have been stretched. Investors are also concerned about the lack in approval of a second US stimulus package and this weekend’s US-China talks.

Dow Jones Sector performance 13-8-2020

Source: Bloomberg, DailyFX

Source: Bloomberg, DailyFX

Technically, the Dow Jones is challenging a key resistance at 28,000 – the 161.8% Fibonacci extension. The index may face some selloff risk at this level but its overall momentum remains bullish. Breaking above 28,000 resistance will likely open the room for more upside towards the 200% Fibonacci extension at 29,600.

Dow Jones Index – Daily Chart

DAX 30 Outlook:

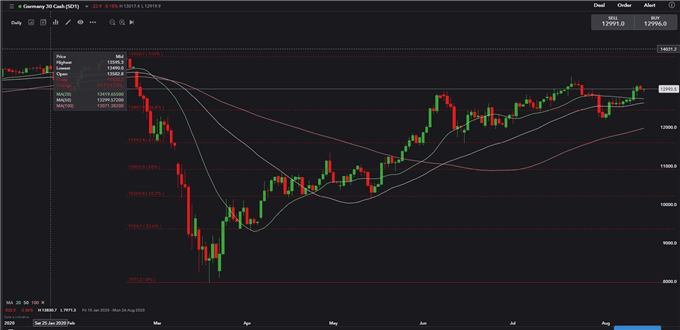

Germany’s DAX 30 index stock market benchmark ended 0.5% lower on Thursday, consolidating at a key resistance level at 13,000. Payment company Wirecard was reported to be removed from the DAX index soon, as the company collapsed into insolvency in June.

Technically, the DAX came to a key resistance at 13,000 – the previous high seen in end July. Its overall trend remains bullish, as suggested by upward-sloped 20-Day, 50-Day and 100-Day Simple Moving Averages (SMA) lines. Breaking above 13,000 would likely open the room for more upside towards 13,800 – the all-time highs.

Dax Index – Daily Chart

Nikkei 225 Index Outlook:

Technically, the Nikkei 225 index has broken above its range-bound zone between 21,800 to 22,900 this week, as highlighted in the chart below. The immediate resistance level can be found at around 22,300, which is the previous high seen in early June. Breaking above 22,300 will likely pave way towards the pre-Covid high at 24,000.

Nikkei 225 Index – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter