S&P 500 VIX INDEX ‘FEAR-GAUGE’ DROPPING & TREASURY YIELDS SPIKING AS INVESTORS SHUN BONDS FOR STOCKS

- S&P 500 price is within striking distance of hitting all-time highs as stocks continue to rally

- US Treasuries selling off as the rotation trade steers investors out of bonds and into equities

- VIX ‘fear-gauge’ under pressure but that may not last if Treasury yield volatility spikes further

Treasury yields are still extending higher. Investors shifting their asset allocations by rotating out of bonds and into stocks stands out as a primary driver of the move. A windfall of debt issuance, which is increasing the supply of US Treasuries, also looks like it may be contributing to the latest surge in sovereign interest rates. For example, since Friday’s trading session, the ten-year Treasury yield has climbed well over 15-basis points and nears 0.7%.

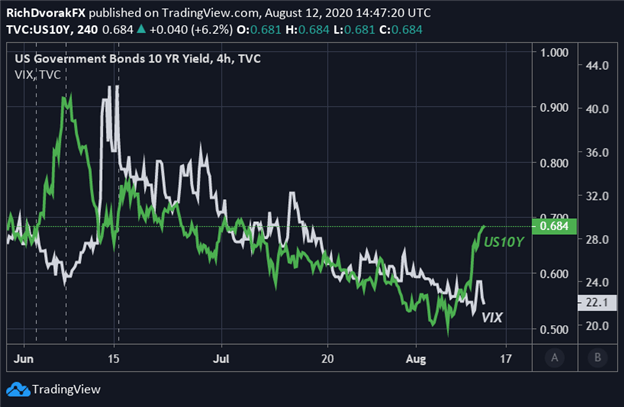

VIX INDEX PRICE VERSUS TEN-YEAR US TREASURY YIELD (CHART 1)

Chart created by @RichDvorakFX with TradingView

Last time US Treasury yields ascended sharply like this was roughly two months ago. The aggressive selloff in ten-year Treasuries between 02-08 June pushed rates from about 0.70% to the 0.90% level. This was then followed by a notable spike higher in volatility, illustrated by the VIX Index ‘fear-gauge,’ as major stock market indices turned lower once yields started to recoil.

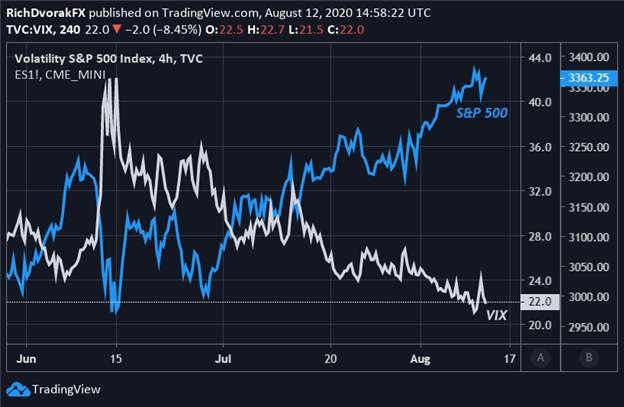

VIX INDEX PRICE VERSUS S&P 500 INDEX PRICE (CHART 2)

Chart created by @RichDvorakFX with TradingView

On that note, it may be reasonable to consider the chance that stocks slump again in the event that Treasury yields gravitate back toward historic lows. Perhaps the annual Jackson Hole Symposium scheduled later this month could be used as a platform by the Federal Reserve for the central bank to double down on its commitment to keeping benchmark interest rates anchored near zero.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -1% | 0% |

| Weekly | 15% | -13% | -1% |

This might motivate investors to pile back into bonds. If so, it could bode poorly for the rotation trade currently weighing positively on stock prices and negatively on bonds. Owing to the inverse relationship typically held between volatility and stocks, this would likely provide a positive boost to the S&P 500 VIX Index similar to what was witnessed this past June.

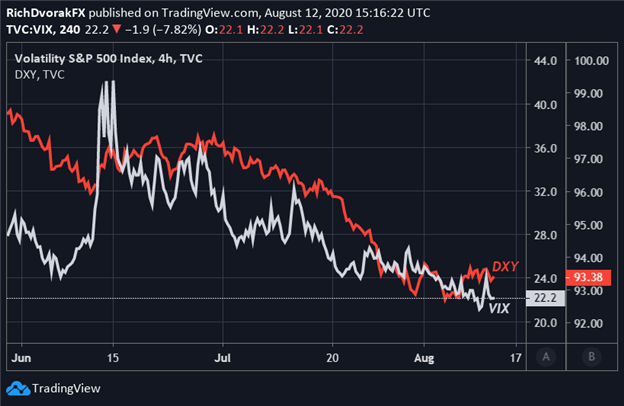

VIX INDEX PRICE VERSUS US DOLLAR DXY INDEX PRICE (CHART 3)

Chart created by @RichDvorakFX with TradingView

Along with a rally in the VIX Index that would likely correspond with a retracement lower in Treasury yields and the S&P 500, there may be potential for the anti-risk US Dollar to catch a bid as well. The US Dollar is a top safe-haven currency that tends to rise amid deteriorating market sentiment, which is largely due to its vast liquidity and status as the reigning world reserve currency.

Keep Reading – Markets in Limbo as Volatility Gyrates: VIX, EVZ, VXEEM, OVX

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight