Gold & Silver Analysis & News

- US Real Yields a Key Driver for Gold

- Why the Surge in Bond Yields?

- Gold & Silver Bounces from 50% Retracement of Summer Surge

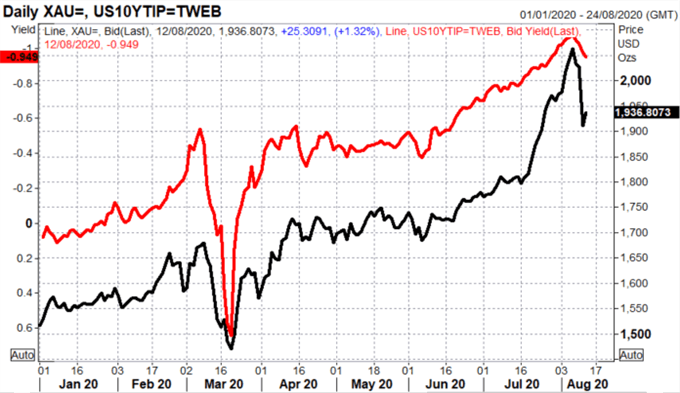

US Real Yields a Key Driver for Gold

Yesterday saw the precious metals complex come under significant selling pressure with the gold price dropping 5.7%, the largest fall since April 2013, while silver crashed 14.95%, marking its biggest plunge since October 2008. While arguably precious metals were in need of a correction given their sizeable rise, the fall coincided with a surge higher in bond yields, in particular US real yields, which have been the largest driver behind the move in the precious metals complex.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

Top in US Real Yield Marks Short-Term Top in Gold

Source: Refinitiv

Why the Surge in Bond Yields?

Among the key catalysts behind the push higher in US yields was the anticipation of a large supply of US Treasuries. Last week's quarterly refunding announcemen saw a record USD 112bln in borrowing for this week's auctions. This is USD 16bln larger than the package announced last quarter and also marked an interim bottom in US 10yr yields (now 17bps higher since the record low). Alongside this, the surge in corporate issuance is another contributing factor behind the push higher in US bond yields as well as better than expected US data, most notably Friday’s US NFP report that signalled that the recovery remains intact.

US 10yr Yields Put in Short-Term Bottom Last Week

Source: Refinitiv

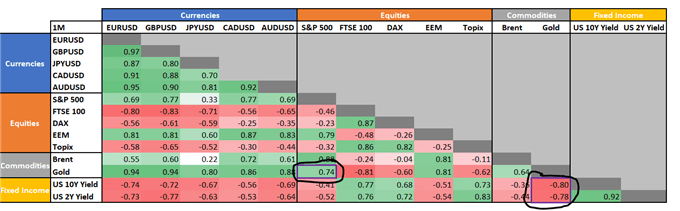

Gold has Moved in Lockstep With Equities

Elsewhere, while some market participants may have attributed the decline in gold due to the risk-on bid seen in European bourses throughout yesterday’s session, I disagree with this view given that precious metals have largely moved in lockstep with the stock market for several months now amid the unprecedented global monetary policy and fiscal stimulus across the globe. In turn, I place greater weight on the bond market. As shown in the cross-asset correlation matrix, US yields have had a strong negative correlation with gold.

Cross-Asset Correlation Matrix

Source: DailyFX, Refinitiv

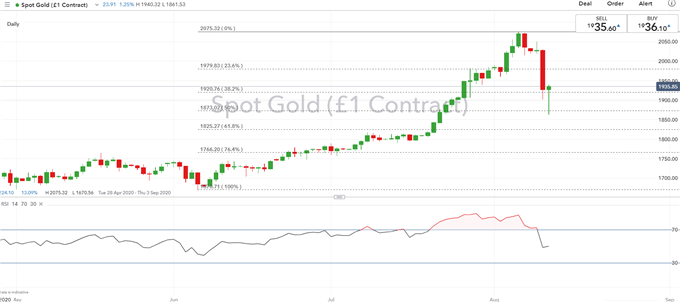

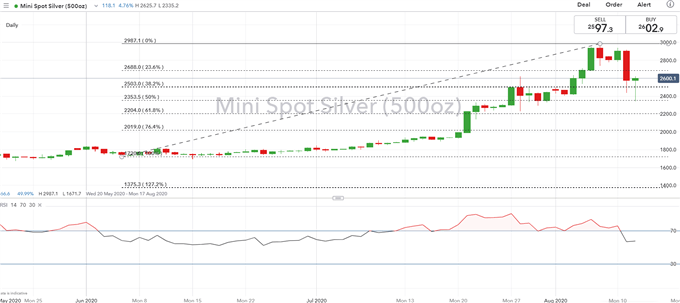

Gold & Silver Bounces from 50% Retracement of Summer Surge

Gold Price Chart: Daily Time Frame

Source: IG

Silver Price Chart: Daily Time Frame

Source: IG