EUR/GBPTalking Points:

- The Office for National Statistics reported a record 20.4% decline in quarterly GDP

- EUR/GBP fixated on the 0.9000 level after muted response to GDP data

- IG Client Sentiment hints at further upside as the majority of EUR/GBP traders remain short

UK GDP Prints Largest Quarterly Decline on Record

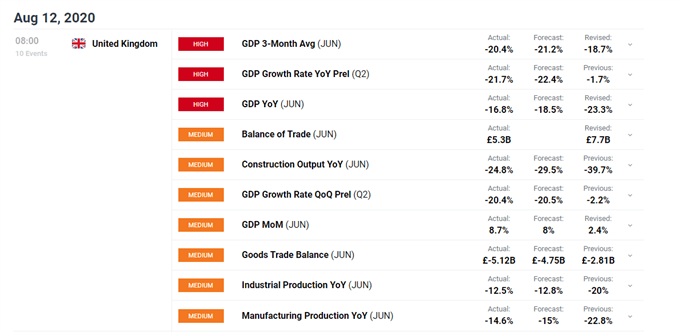

The Office for National Statistics confirmed that the UK economy had contracted by 20.4% for the second quarter of 2020 (April – June), slightly better than the -21.2% estimate. The official data places the UK into a technical recession ( two consecutive quarters of negative growth), but there was some good news in the monthly data.

The June GDP figure reflects that the UK economy expanded 8.7% when compared to May, which largely reflects the positive economic impact related to the easing of lockdown regulations.

UK Economic Data

For all market-moving data releases and events see the DailyFX Economic Calendar

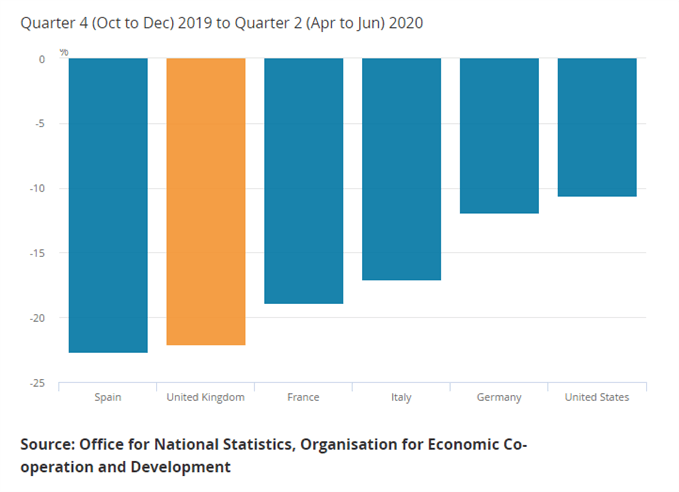

The UK has been particularly hard hit this year an this can be seen when comparing the first half of 2020 with its peers. The UK has witnessed a fall of more than double that experienced in the US over the same time period of (-22.1% vs - 10.6%).

UK Half Yearly GDP vs Selected OECD Partners

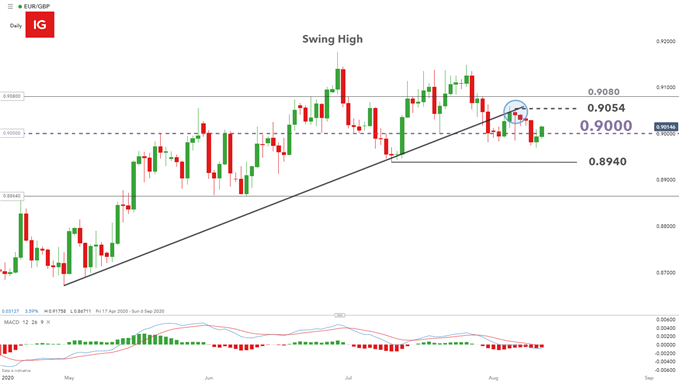

EUR/GBP Technical Levels

The currency pair has halted the multi-month bullish trend recently and has broken below the corresponding trendline support on the last day of July. The first week of August, however, saw price approach the trendline once more, this time as trendline resistance, and failed to break higher.

The failed move has helped to form a second lower high since the June swing high, hinting at possible buyer exhaustion. Should this be the case, bears will look for a close below the psychological 0.9000 level which opens the door to a potential drop towards the 0.8940 level.

However, a break and close above 0.9000 may be suggestive that bulls aren’t done just yet which brings into play the 0.9054 ahead of the 0.9080 level.

Chart prepared by Richard Snow, IG

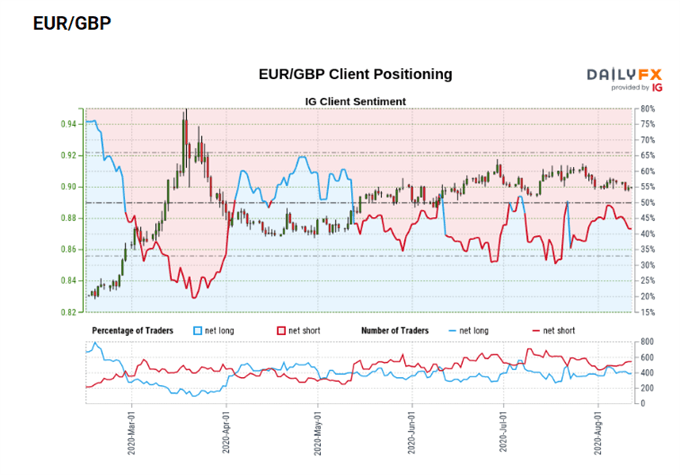

IG Client Sentiment Hints at Further Bullish Momentum

- IG Client sentiment data shows 59.92% of EUR/GBP traders remain short.

- Traders are further net-short than yesterday and last week while longs were reduced compared to yesterday and last week, respectively.

- When read as a contrarian indicator, this suggests prices may continue to rise.

| Change in | Longs | Shorts | OI |

| Daily | -4% | -2% | -4% |

| Weekly | -9% | 5% | -6% |

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX