Nasdaq 100 Price Forecast:

- The Nasdaq breached the psychologically significant 10,000 mark for the first time ever on Tuesday

- Bulls rejoiced at the significant achievement, but much uncertainty remains

- First and foremost is the upcoming FOMC rate decision which has the ability to fuel or furlough the rally

Nasdaq 100 Breaches 10,000 for the First Time Ever, Bulls Rejoice

The Nasdaq 100 scored an incredible achievement on Tuesday as it crossed the 10,000 mark for the first time in history. While the remarkable recovery has seen the Nasdaq reach new heights, the S&P 500 and Dow Jones – along with other global equity markets like the DAX 30 and FTSE 100 – remain beneath their covid-19 peaks. In turn, we can look to the stellar performance of large cap technology stocks like Microsoft, Facebook, Google, Apple and Amazon, all of which possess significant influence on the Nasdaq, as key drivers of the recovery rally.

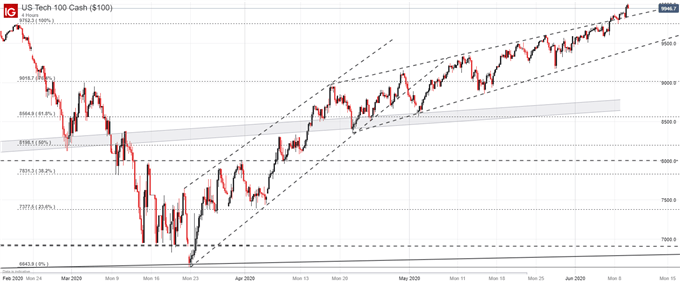

Nasdaq 100 Price Chart: 4 – Hour Time Frame (February – May)

But even these innovators and industry leaders have a basis in the underlying economy which remains fragile. Thus, many market participants have called the current recovery overbought and indeed, symptoms of euphoria are widespread as shares of companies that have gone bankrupt (Hertz) surge to deliver massive gains to those willing to weather the risk.

Elsewhere, companies with few products or name recognition (Nikola) have surpassed the market capitalizations of household names like Ford and General Motors. All in all, it is becoming more difficult to refute the claim that a detachment from fundamental economics has occurred – at least to some degree.

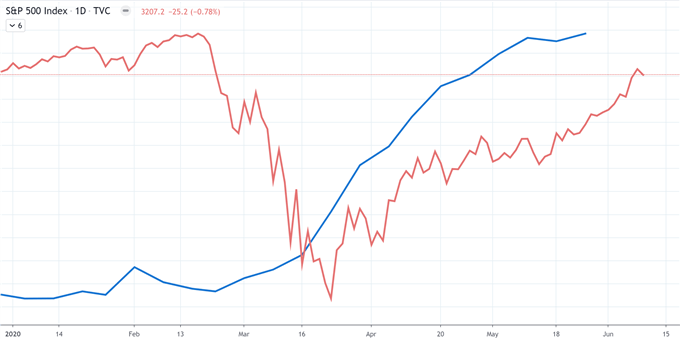

S&P 500 in Red Overlaid with Money Supply (M1) in Blue

Chart created with TradingView

Detractors would say the rally is being fueled by an economic recovery and, possibly above all, the Federal Reserve. With the onset of coronavirus and quarantine, the central bank expanded its balance sheet at a blistering pace and the supply of money in the United States has surged in a manner similar to that of the Nasdaq 100, Dow Jones and S&P 500.

This relationship, whether directly correlated or not, has caught the eye of many and in turn, has become a crucial aspect of the rally in my opinion. Therefore, it is almost poetic that the day before the June FOMC rate decision, the Nasdaq reaches a massive psychological milestone because the central bank has the potential to add more fuel to the recovery or pull the rug out from underneath.

To be sure, the fate of the recovery could rest in the hands of the Fed. If the central bank should announce a policy plan that will halt balance sheet growth or begin to wind down its expansion, risk appetite should take a hit as investors begin to forecast a relatively more restrictive monetary policy regime.

Will the Fed Go Negative in June?

On the other hand, measures that would expand the balance sheet further may only fuel another leg higher, but run the risk of inflating asset valuations. Either way, the Nasdaq, S&P 500 and Dow Jones will closely watch Wednesday’s meeting and the takeaways could make or break market sentiment. In the meantime, follow @PeterHanksFX on Twitter for updates.

--Written by Peter Hanks, Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX