British Pound (GBP) – EU/UK Talks, US NFPs and GBP/USD Forecast, Chart and Analysis:

- GBPUSD looking to break above the 200-day moving average.

- EU/UK Trade talk and US Non-Farm Payrolls will decide pre-weekend price action.

GBP/USD Continues to Benefit From an Ailing US Dollar

Cable is trading around 1.2650 in early turnover and is back at highs last seen in mid-March as the pair continue to make a short-term series of higher lows and higher highs. Sterling as a currency is not particularly strong but GBP/USD upside is being driven by ongoing weakness in the US dollar, with the pair gaining around 350 pips (low-to-high) this week. This recent move may soon come under pressure with both the latest EU/UK trade talk update from EU chief negotiator Michel Barnier, expected at 12:00 BST, and the latest US jobs report at 13:30 BST.

The post-Brexit trade talks are unlikely to have sufficient progress this week to help underpin the British Pound. The stand-off over the three main areas of contention shows no sign of easing and it looks increasingly likely that European leaders will intervene soon to try and break the deadlock, according to one German official. Speaking to the European Policy Center think-tank on Thursday, German ambassador Michael Clauss said that while no progress had currently been made, reaching a deal was possible if the UK changed their stance, but warned that it was not possible for the UK to keep full sovereignty and have unfettered access to the EU internal market at the same time. EU chief trade negotiator Michel Barnier is expected to give an update on this week’s trade talks at 12:00 BST.

Later today, the monthly US jobs report (NFPs) is expected to show that another 8 million people in the US joined the unemployment line in May, sharply lower than the 20.5 million seen in April, while the country’s unemployment rate is expected to jump to 19.8% compared to last month’s 14.7%.

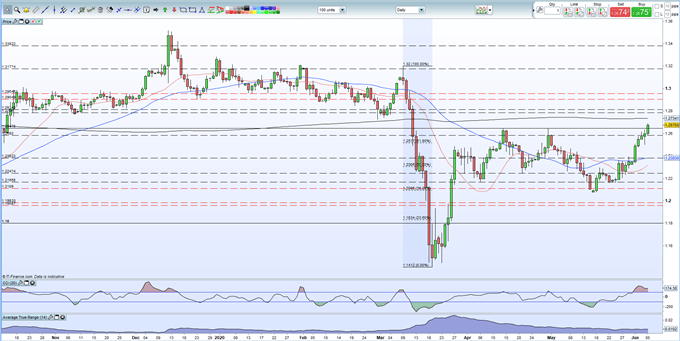

The daily GBPUSD chart continues to flash bullish signals and the pair are closing in on resistance off the 200-dma at 1.2734. Higher lows and highs highlight the positive sentiment in the pair and the CCI indicator show that GBPUSD remains extremely overbought. Near-term price action will depend on the EU/UK negotiation update and US NFPs and after this week’s solid rally, any US strength or Sterling weakness could see gains pared going into the weekend with 1.2480 – 1.2500 a likely area of support.

GBP/USD Daily Price Chart (December 2019 – June 5, 2020)

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Sterling (GBP) – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.