British Pound (GBP) – EU/UK Talks and GBP/USD Forecast, Chart and Analysis:

- EU/UK trade talks to continue against a backdrop of ‘no deal’ warnings.

- GBP/USD short-term outlook improves.

GBP/USD Regains 1.2400 as the US Dollar Slips Lower

The EU and UK trade negotiating teams will continue post-Brexit trade discussions this week with both sides dialing up the blame game rhetoric. EU chief negotiator Michel Barnier said over the weekend in an interview with The Sunday Times that the UK is not keeping to its original commitments and that there would not be an agreement ‘at any cost’. In response, a UK government ‘source’ quoted by The Daily Telegraph said that it is the EU who are dragging their feet and that the commission ‘are either not ready or not willing to inject momentum’. If no progress is made this week, the odds will shorten on the two parties trading on WTO terms from the start of next year.

UK Chancellor of the Exchequer Rishi Sunak is said to be drawing up plans for an emergency stimulus package in early July, in a further attempt to re-boot the UK economy. Sunak fears that the UK hospitality sector could lose as many as two million jobs if it is not re-opened by the summer. The Chancellor also said that furloughed workers could return to work on a part-time basis in July, one month earlier than previously stated, while businesses must start contributing towards staff costs from August.

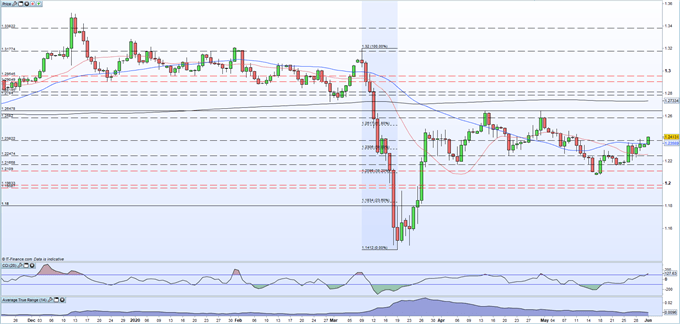

GBPUSD currently trades either side of 1.2400, continuing last week’s push higher. Friday’s month-end rebalancing saw Sterling better bid and the US dollar better offered, underpinning the pair. GBP/USD continues to make a series of short-term higher lows and is now back above the 50-dma. The 50% Fibonacci retracement level at 1.2306 should act as short-term support and the 61.8% Fib level at 1.2517 as resistance.

GBP/USD Daily Price Chart (December 2019 – June 1, 2020)

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Sterling (GBP) – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.