Australian Dollar, Chinese Industrial Production, Retail Sales Data, Talking Points:

- Chinese industrial production rose by 3.9% in April, well ahead of the 1.5% expected

- Retail sales were down 7.5%, slightly worse than forecast

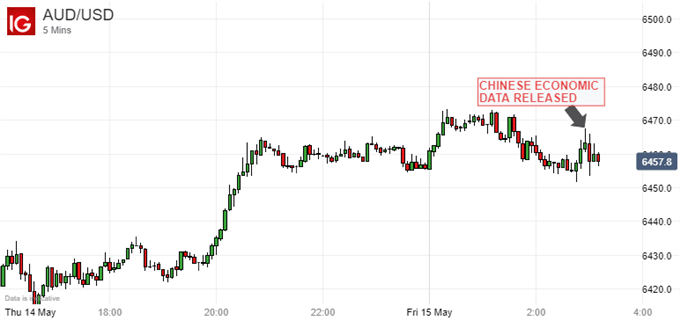

- The Australian Dollar seemed to take the numbers as broadly in-line

The Australian Dollar remained captive to global risk appetite on Friday and didn’t get much traction from a mixed set of Chinese economic numbers.

Official industrial production data showed output up by a very strong 3.9% in April. This was well above the 1.5% gain expected and hugely better than the 1.1% slide seen in March. Retail sales were gloomier, falling by 7.5% against expectations of a 7% fall. Fixed asset investment slipped by 10.3% on the year, nasty but better than the previous month’s 16.1% slide.

All up these numbers suggest that industrial China is getting quickly back to form after the hiatus forced on it by Covid. Retail weakness is of course understandable but hardly confined to China at this point.

The Australian Dollar can act at the market’s liquid proxy for the Chinese economy but don’t seem to have done so in this case. AUD/USD had been edging lower through the Asian morning and the numbers provided a modest respite from that process.

The currency has risen quite sharply against the US Dollar from its coronavirus-induced lows of March. Like all major growth-correlated assets the Aussie has found support in the various massive monetary and fiscal rescue programs put in place around the world, led by the multi-trillion-dollar efforts of the United States.

However, that bullishness has waned somewhat in the past two weeks, replacing upward movement with range-trade for AUD/USD. The prospect of deep global recession is understandably giving investors pause as they survey such economic numbers as this’s week by catastrophic Australian jobless data.

At present forecasters are sticking with the thesis that, while the year’s first half is now beyond saving for the global economy, recovery will be relatively swift. Any data which argue against that thesis are likely to see the Australian Dollar track lower with all other similarly risk sensitive assets.

Australian Dollar, Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!