CAC 40 Price Outlook:

- The CAC 40 closed near its session lows on Thursday following an ECB rate decision

- With a shooting star formation on the 4-hour chart, the index may continue lower in the days ahead

- Euro Price Outlook: EUR/USD Stable as ECB Takes Further Action to Boost Eurozone Economy

CAC 40 Forecast: Index Bleeds Lower Following ECB Meeting

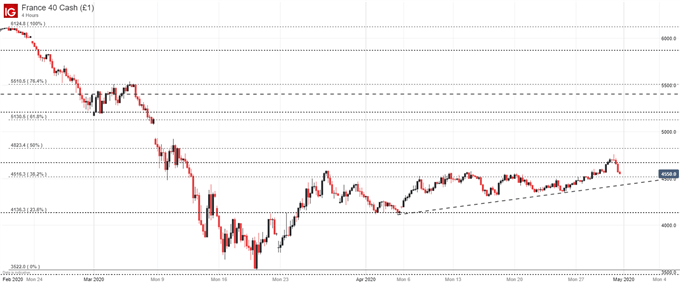

The CAC 40 moved lower on Thursday following an ECB rate decision, rounding out the session near its intraday lows. While the initial reaction to the event was relatively muted, subsequent price action may suggest market participants were unconvinced. Coupled with the passing of key event risk, the 4-hour price chart reveals a shooting star candlestick – typically viewed as a reversal pattern.

CAC 40 Price Chart: 4 – Hour Time Frame (February – April)

It would appear the candlestick’s omen was quickly fulfilled, which leads to a question of how far the reversal will progress, not if. With that in mind, the index may look to nearby support around 4,516 and the projected trendline beneath if selling continues. It is still unclear if bearishness will persist, but weakness across equity markets suggests broader risk aversion may be at hand. Therefore, if sentiment weakens further in US trading, or key earnings from Amazon or Apple disappoint, the CAC 40 may continue lower and probe the outlined support.

| Change in | Longs | Shorts | OI |

| Daily | -12% | 26% | 1% |

| Weekly | -8% | 4% | -3% |

That said, IG Client Sentiment Data reveals retail traders are overwhelmingly short the French equity index which we typically view as a sign weakness may continue. However, recent developments highlight a significant increase in long exposure – clouding the signal somewhat. The number of traders net-long is 21.83% higher than yesterday and 3.83% lower from last week, while the number of traders net-short is 22.59% lower than yesterday and 15.70% lower from last week.

Therefore, sentiment data may suggest price is headed lower in the shorter-term while remaining constructive for longer-term growth. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX