Crude Oil Price Analysis & News

- Oil Prices Post Record Drop Saudi Arabia Sparks Oil Price War

- Global Markets Crash, US Equities Hit Limit Down

- Coronavirus Prompts Contraction in Oil Demand

Oil Prices Post Record Drop Saudi Arabia Sparks Oil Price War

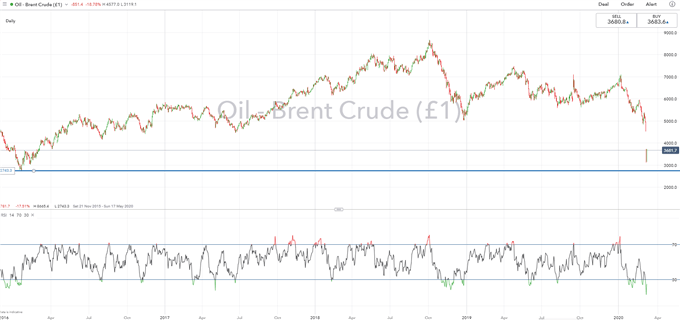

Oil prices saw a record drop at the open, plunging as much as 30% with Brent crude futures hitting a low of $31.05 and WTI crude futures falling below $30/bbl. This had come amid Saudi Arabia starting an oil price war after slashing their official selling prices (Arab light crude oil cut by $6/bbl) by the most in three decades, which had been in response to OPEC and Non-OPEC failing to reach an agreement to cut oil production further after Russia’s refusal to participate. That said, the move by Saudi Arabia appears similar to that of 2014, where the country is attempting to regain market share from US shale producers.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | 1% |

| Weekly | 31% | -38% | 7% |

However, with the outlook already weak for oil prices given that the spread of coronavirus has reduced demand for oil amid countries imposing travel limits. As such, IEA are expecting the first contraction in oil demand since 2009 after cutting its forecast by 1mbpd. Consequently, we are reminded by the events of mid-2014 where a plunge in oil prices prompted a widening of corporate credit spreads, particularly high yield credit.

Oil Producer Brent Oil Fiscal Break-Even Price

- Saudi Arabia ($83.6), Russia ($42.4), Iraq ($60.3), Iran ($194.6), UAE ($70), Kuwait ($54.7), Qatar ($45.7), Libya ($99.7), Algeria ($109)

US Shale WTI Oil Price Break-Even for operating expenses

- Permian Midland ($27), Eagle Ford ($28), STACK ($33), Permian Delaware ($35), Permian Other ($37)

How to Trade Oil: Crude Oil Trading Strategies & Tips

Oil Impact on Currency Markets

Plunging oil prices to weigh on net oil exporters vs anti-risk currencies

Net Oil Importers: KRW, ZAR, INR, TRY, EUR, CNY, IDR, JPY

Net Oil Exporters: RUB, CAD, MXN, NOK.

Brent Crude Oil Price Chart: Daily Time Frame

--- Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX