US Dollar, EUR/USD, GBP/USD, USD/JPY, USD/CAD Price Analysis

- Today marked the start of the Fed’s twice-annual Humphrey Hawkins testimony.

- A number of additional drivers remain on the calendar for this week, including tomorrow’s release of US CPI for the month of January.

- US Dollar strength has run very loudly so far through February, with the currency finally finding some element of resistance earlier today.

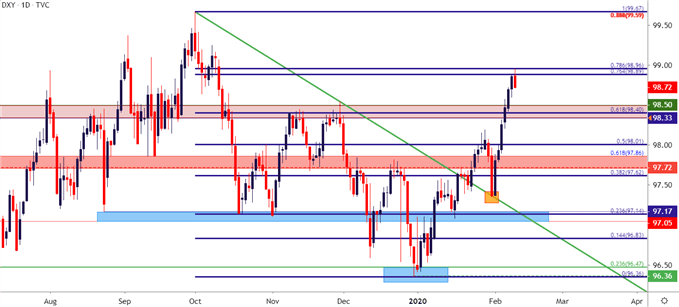

US Dollar Bullish Breakout into Key Resistance

The US Dollar’s bullish trend finally ran into some element of resistance today just ahead of Chair Powell’s Humphrey Hawkins testimony on Capitol Hill. The Greenback has had a strong outing so far in February, gaining each trading day of the month until this morning’s pullback came into play. Prices found a high off of the 78.6% retracement of the Q4 sell-off, and since then a bit of a pullback has started to show.

For longer-term approaches, this can be attractive for bearish swing scenarios. On a shorter-term basis, recent momentum can remain attractive on the long side, looking for this recent pullback to be a corrective part of a bullish item of continuation.

US Dollar Daily Price Chart

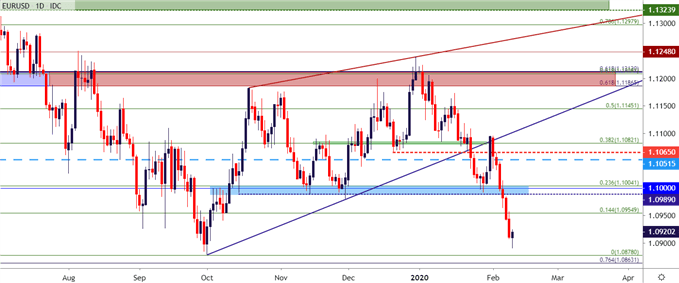

EUR/USD Breaks Down, Pulls Back from Two-Year Lows

At the core of that USD-strength has been a sell-off in the Euro, with EUR/USD continuing last week’s breakout below the 1.1000 handle in a fairly consistent manner. Price action pushed all the way below the 1.0900 handle, albeit briefly, before a pullback started to show. This can keep the door open for lower-high resistance potential around the same 1.0955 level that was previously looked at for support. Of note, that prior area of well-heeled support has yet to be tested for resistance around the 1.1000 level.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

EUR/USD Daily Price Chart

GBP/USD Pushing Back Towards 1.3000

Similar to EUR/USD above, US Dollar strength has been showing very visibly; albeit to a more exaggerated degree against the British Pound. GBP/USD price action ran into a confluent area of support yesterday which has helped to hold the lows. As looked at short-term, prices are making a push-higher, and that prior zone of support around the 1.3000-handle may soon come back into play, opening the door for lower-high scenarios.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

GBP/USD Four-Hour Price Chart

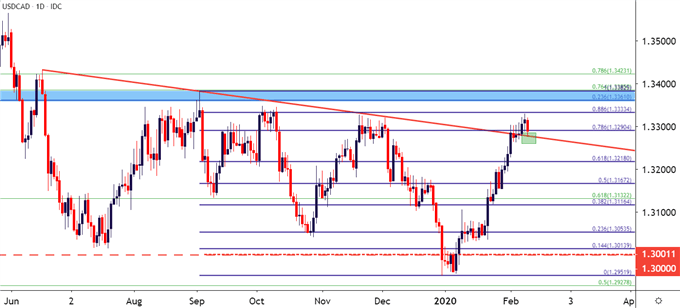

USD/CAD Nears Danger Zone

USD/CAD has put in a notable reversal so far in 2020 after opening the year below the vaulted psychological level of 1.3000. A flip at the BoC in January helped matters, and price action in the pair is now trading near some significant swing highs from the second-half of last year. Follow-through support has shown up at a prior bearish trend-line projection, keeping the door open to long-USD strategies in the pair.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

USD/CAD Daily Price Chart

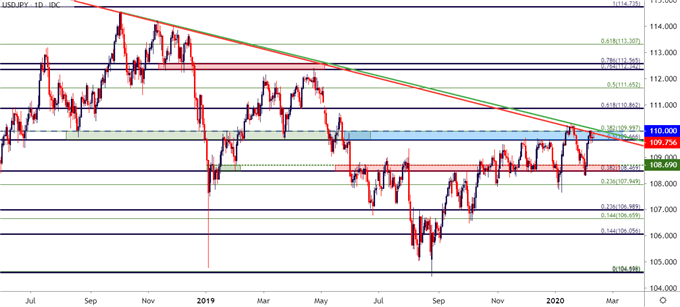

USD/JPY

Notable is how USD/JPY hasn’t really reflected much of that recent USD-strength, with a number of resistance levels sitting just above. The potential for continued risk aversion around the building fear around coronavirus is likely playing a role, and should risk aversion make another appearance, the short-side of USD/JPY can remain as attractive. I had looked into the backdrop around the pair last week with similar motive; and again this morning as that resistance zone remained in-effect.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 2% | 0% |

| Weekly | 12% | -16% | -6% |

USD/JPY Daily Price Chart

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX