US Dollar, EUR/USD, GBP/USD, USD/JPY Price Analysis

- US Dollar strength has continued through February trade.

- Today marks the start of the Fed’s twice-annual Humphrey Hawkins testimony.

- EUR/USD and GBP/USD have both broken-down to go along with that USD-strength.

US Dollar Continues February Rally Ahead of Chair Powell

Today marks the start of the Federal Reserve’s first dose of Humphrey Hawkins testimony for this year. The bi-annual event kicks off with Chair Jerome Powell testifying in front of the House Financial Services Committee, and tomorrow he speaks in front of the Senate Banking Committee. This will begin with the release of a prepared statement from Chair Powell, which has already been released via the Federal Reserve’s web site. At 10 AM ET, he’ll be served up in front of the respective legislative body for Q&A that can be wide-ranging, covering numerous topics. The House, especially, has a tendency to see topics stray from monetary policy so this can make for an interesting outing today.

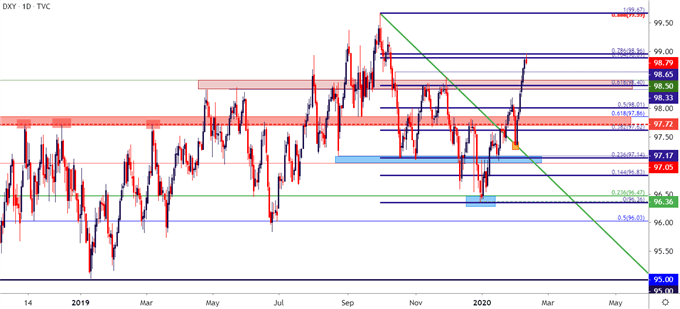

Across markets, a number of key themes remain in the spotlight, key of which has been a really strong showing in the US Dollar through early-February trade. After a post-FOMC pullback to finish off January trade, the US Dollar has now gained every day in February, pushing up to fresh three-month-highs ahead of Chair Powell’s trip to Capitol Hill. That strength, however, does appear to be unevenly distributed, with pain showing in particular in the Euro and British Pound. EUR/USD is nearing a test of two-year-lows while GBP/USD has continued to trade below the vaulted 1.3000 marker.

At this point, the US Dollar has already clawed-back as much as 78.6% of the Q4 sell-off; finding a bit of resistance after the release of the statement but ahead of the start of Chair Powell’s testimony.

US Dollar Daily Price Chart

Positioning Around the US Dollar

Later this afternoon, I’ll look into themes around this scenario in a live webinar that’s free and open to all. Given the remainder of this week’s economic calendar and the number of drivers that remains, FX price action can remain a point-of-interest.

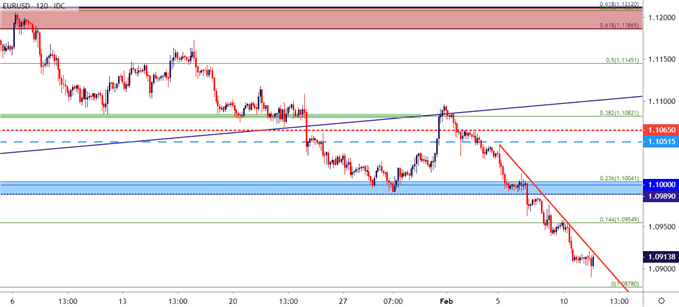

EUR/USD Tanks, Nears Two-Year Lows

Probably one of the biggest push points to the US Dollar trend looked at above has been a sell-off in the Euro. EUR/USD came into February perched just under the 1.1100 handle; and in less than two weeks the pair has broken down through a key area of chart support around the 1.1000 level while making a fast approach towards the two-year-low at 1.0878 that was set on the first trading day of Q4. I had looked into breakdown potential around EUR/USD last week, highlighting deeper support potential around 1.0955 followed by the 1.0900 handle, which has come into play this morning.

The big question ahead of Chair Powell’s appearance is whether EUR/USD sellers can continue to push. Current retail sentiment on the pair remains heavily long, keeping the door open for bearish scenarios as retail traders continue to try to pick a bottom.

| Change in | Longs | Shorts | OI |

| Daily | -9% | -2% | -7% |

| Weekly | -15% | 37% | -2% |

EUR/USD Two-Hour Price Chart

GBP/USD Tests Short-Term Resistance at Prior Support

The Q4 bullish breakout in the British Pound continues to unwind, with prices now testing the 38.2% retracement of the September-December bullish move. A key point of emphasis around this theme was price action pushing back-below the 1.3000-handle that offered numerous support inflections in late-January trade. But with that price now being broken-through, the big question is whether sellers return to offer resistance at-or-around prior support, keeping the door open for bearish trend strategies in the pair.

Similar to EUR/USD above, retail sentiment remains heavily long as traders attempt to call a top on the USD.

| Change in | Longs | Shorts | OI |

| Daily | -2% | -13% | -5% |

| Weekly | -5% | 8% | -1% |

GBP/USD Four-Hour Price Chart

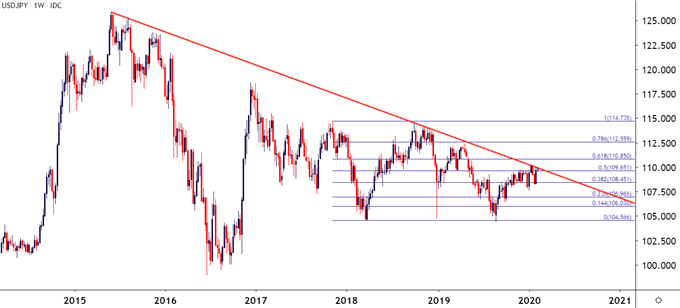

USD/JPY Holds at Key Resistance

Despite the blistering bullish trend in the US Dollar, USD/JPY has remained at a key point of longer-term resistance over the past week as taken from a bearish trendline drawn from the 2015 high and connected to the 2018 swing high.

USD/JPY Weekly Price Chart

On a shorter-term basis, there’s an element of confluence around current resistance, with a couple of Fibonacci levels creating a zone that held the highs through December trade, coming back into play last week to set a lower-high. This can keep focus on the short-side of the pair, particularly for risk aversion scenarios as the anti-risk Yen may take on preference in safe-haven-like environments.

Retail sentiment remains somewhat mixed here, failing to offer a discernible bias in either direction at this point.

| Change in | Longs | Shorts | OI |

| Daily | -17% | -2% | -4% |

| Weekly | -13% | 5% | 2% |

USD/JPY Daily Price Chart

USD/JPY on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX