US Dollar Talking Points:

- Tomorrow brings the first FOMC rate decision of 2020.

- There are minimal expectations for any actual moves but quite a bit of divergence in expectations for later this year.

- Clues and hints will be carefully watched for and this will likely set the tone in the US Dollar.

US Dollar Rallies Ahead of First FOMC Rate Decision of 2020

Tomorrow brings the first Federal Reserve rate decision in 2020 and there are minimal expectations for any actual change. Nonetheless, current probabilities indicate an approximate one-in-eight chance of a 25 basis point hike. This contradicts expectations for later in the year, as there’s a current 72.1% chance of at least one cut and a 35.3% chance of at least two rate cuts by the end of 2020.

So, as has become usual, the importance will be in the details of tomorrow’s statement and accompanying press conference; after which market participants will further gauge the potential for rate moves out of the bank later in the year.

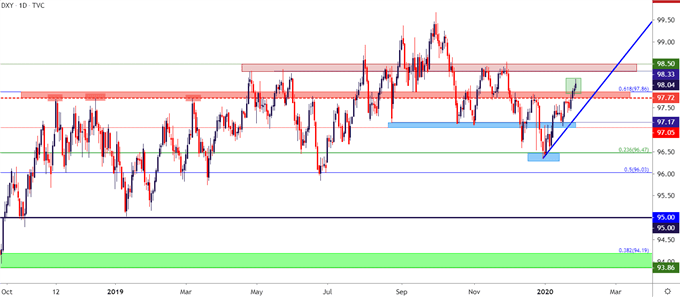

The US Dollar has clawed back a large portion of those December losses, and additional resistance potential sits overhead in the 98.33-98.50 zone on DXY.

US Dollar Daily Price Chart

Chart prepared by James Stanley; US Dollar on Tradingview

EUR/USD Tests 1.1000 Handle

EUR/USD is back to testing the same support that came into play to help hold the November lows, taken from around the 1.1000 psychological level.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

EUR/USD Daily Price Chart

Chart prepared by James Stanley

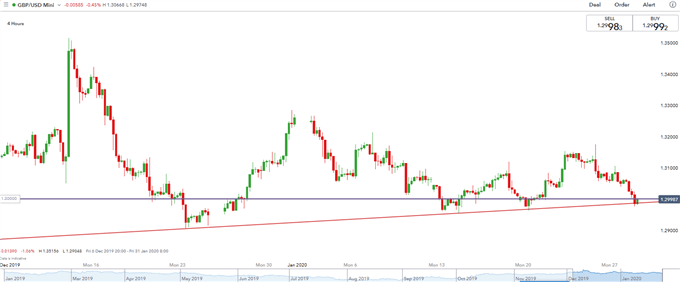

GBP/USD Tests 1.3000 Psychological Level

Similarly, GBP/USD is testing a confluent area of support around a key psychological level, taken from around the 1.3000 handle on the pair. This same price helped to set resistance in October as that bullish breakout took a pause.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

GBP/USD Four-Hour Price Chart

Chart prepared by James Stanley

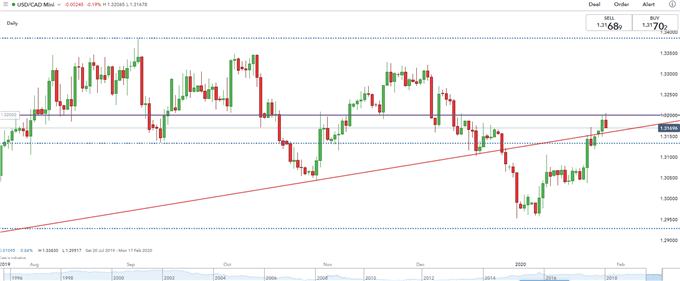

USD/CAD Reversal Potential

USD/CAD has continued to rally into this week, intersecting with a big zone of resistance running from 1.3181-1.3205. That area has helped to hold the highs and that can keep the door open for short-side strategies going into tomorrow.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

USD/CAD Daily Price Chart

Chart prepared by James Stanley

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX