EUR/USD Price, Chart and Analysis

- EUR/USD now trading below all three moving averages

- ECB and PMIs heaving into view.

EUR/USD Hindered by Negative Backdrop

A lot of moving parts currently pushing EUR/USD price action with the majority being negative. From a fundamental point of view, news that Luigi di Maio will step down as leader of the Five Star movement has weighed on the single currency, while the latest broadside from US President Trump that he will put a 25% tariff on EU autos if the two sides are unable to make a deal, brings trade wars back into focus. The EU have said that they will push ahead with the proposed digital tax, leaving an escalation in the dispute between the two sides likely.

Euro Under Dark Clouds as Trump Threatens Auto Tariffs

Euro Traders Eye ECB Meeting and Euro-Zone PMIs

This week will see the latest ECB monetary policy announcement (Thursday) and accompanying press conference and the first look at sentiment in the Euro-Zone via the Markit manufacturing, services and composite PMIs on Friday. Tuesday’s ZEW releases, all better than expected, showed a strong rebound in Euro-Zone optimism and Euro bulls will be looking for more of the same on Friday. The ECB are fully expected to leave all monetary policy levers untouched on Thursday, but President Christine Lagarde may give more details about the central bank’s strategic review into the effectiveness of its monetary policy and how it affects the ECB’s price stability mandate.

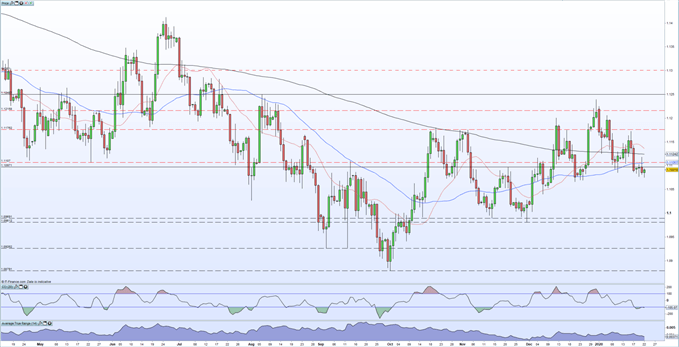

EUR/USD Price – Chart Remains Biased Towards the Downside

Today’s break lower and one-month low print suggests that sellers remain in control of price-action. While it can be argued that the longer-term outlook for the Euro is positive, the breaking of a series of lower highs and new lower lows from late October, the short-term set-up suggests a re-test of 1.1000. The pair are trading below all three moving averages and may further selling will bring 1.1065 and then 1.1040 in play before the short-term target of the 1.0981 – 1.0989 zone comes into view. The CCI indicator is in oversold territory and may slow any further move lower. Resistance levels between 1.1106 and 1.1124.

EUR/USD Daily Price Chart (April 2019 – January 22, 2020)

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on the Euro and the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.