Australian (AUD) Dollar Forecast:

- The Australian Dollar had an underwhelming response to the US-China trade deal

- Does this speak to a potential reassessment of the deal’s impact on the growth-sensitive currency?

- Further, AUD/USD, AUD/CAD and AUD/NZD find themselves underneath nearby resistance

Australian Dollar Outlook

The announcement and subsequent signing of the phase one agreement between the United States and China has helped bolster risk assets in recent weeks as the S&P 500 has enjoyed strength to begin 2020. That being said, AUD pairs have been less enthusiastic than their equity counterparts as various pairs struggle to maintain gains in the new year. Without a clear bullish fundamental driver moving forward, can AUD press higher or will the remnants of Aussie strength fade as the euphoria around the trade deal wanes?

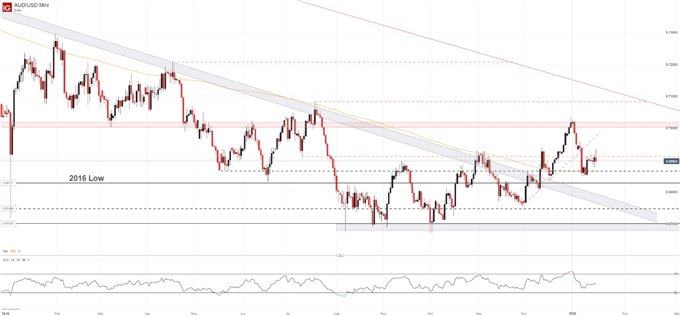

AUD/USD Forecast

Against the US Dollar, the Australian Dollar recently employed the 200-day simple moving average for support as tensions in the Middle East sparked a brief stint of risk aversion. Now, however, risk appetite has returned – as evidenced by new highs in the S&P 500 - and AUD/USD has rebounded but overhead resistance kept price in check on Thursday.

AUD/USD Price Chart: Daily Time Frame (April 2018 – January 2020) (Chart 1)

A long upper wick on the daily chart highlights a lack of bullish conviction, which could be concerning given the resistance to come. If the pair is unable to establish a new high above the January 1, 2020 level, it would break the series of higher-highs and higher-lows which would compound the evidence of waning bullish conviction. Thus, in pursuit of a medium-term continuation higher, look for AUD/USD to trade above 0.7018. In the meantime, follow @PeterHanksFX on Twitter for updates.

AUD/CAD Forecast

Shifting focus to AUD/CAD, the nearby 200-day simple moving average may keep a lid on bullish momentum in the shorter-term. Unlike AUD/USD, AUD/CAD has been unable to pierce the descending trendline which leaves the pair with a more difficult road ahead if it is to press higher. With that in mind, AUD/CAD is an attractive opportunity for strategies looking to capitalize on Australian Dollar weakness over the medium to longer term.

AUD/CAD Price Chart: Daily Time Frame (April 2018 – January 2020) (Chart 2)

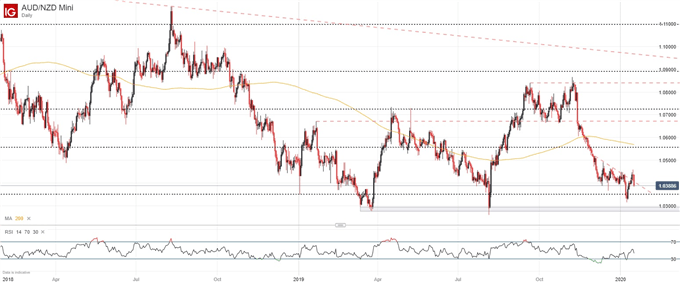

AUD/NZD Forecast

Conversely, AUD/NZD may provide bullish opportunities across a shorter timeframe. As I noted last week, longer-term Aussie weakness is likely versus the New Zealand Dollar, but currently rests near support and is a safe distance from more-robust technical resistance. Therefore, AUD/NZD may offer a better risk-reward profile, from a bullish perspective, than the other two pairs discussed.

AUD/NZD Price Chart: Daily Time Frame (March 2018 – January 2020) (Chart 3)

Still, Aussie strength may require a catalyst outside of simple risk appetite given the currency’s indifference to the risk-rally on Thursday. Either way, the Australian Dollar will have its work cut out for it if it is to continue higher in the days and weeks to come as the fundamental landscape behind it falls under pressure.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: How to Invest During a Recession: Investments & Strategy