Sterling (GBP) Price, Chart and Analysis

- BoE dove Michael Saunders speaks Wednesday.

- GBP/USD support still holds but remains under pressure.

GBP/USD Nears a Cluster of Supportive Trade Action

Recent dovish commentary from various members of the Bank of England’s monetary policy committee continues to weigh on GBP/USD, pushing the pair below 1.3000 and back to lows seen in late-December. The dovish shift, started by BoE governor and continued by MPC members Silvana Tenreyro and Gertjan Vlieghe, may well get an extra nudge tomorrow when known MPC dove Michael Saunders speaks in Northern Ireland at 08:40 GMT – the speech will be published on the BoE website. Saunders is currently one of two MPC members voting for a 0.25% cut, the other is Jonathan Haskel, so any doubling-down of rhetoric may well see GBP/USD test support with renewed vigor.

Wednesday will also see the release of the latest UK inflation data, with price pressures expected to remain unchanged from November, while on Friday the December retail sales figures are expected to show a healthy pre-Christmas pick-up.

For all market moving data releases and events, please see the DailyFX Calendar.

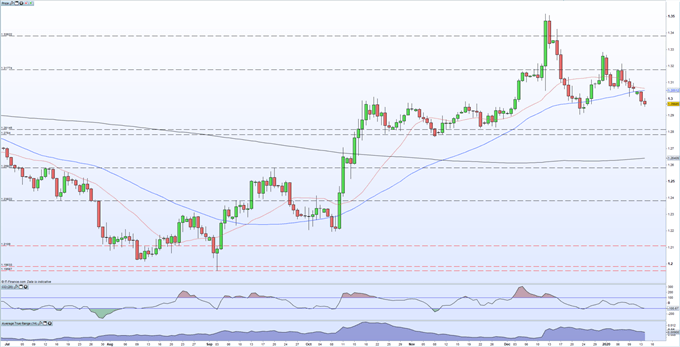

The daily GBP/USD chart shows a series of prior lows and highs between a 1.2920 down to just below 1.2800. These should remain supportive for Sterling against the US dollar going forward, despite the pair now being below both the 20- and 50-day moving averages. A clear break above theses dmas is needed to boost positive sentiment in the pair. The CCI indicator is just touching oversold territory, an area that is not been in since early-November – aside from a very brief Christmas foray – and this may slow down any further sell-off if it occurs.

GBP/USD Daily Price Chart (July 2019 – January 14, 2020)

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Sterling (GBP) – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.