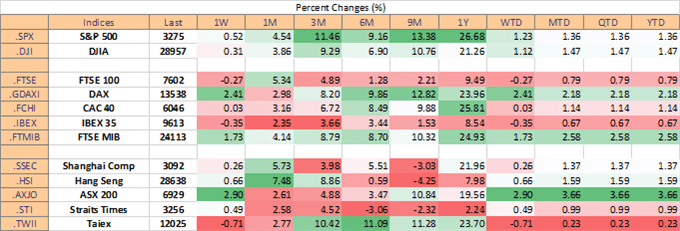

DAX 30 Price Analysis & News

- DAX Outlook: Chasing Record High Above 13,600

- Phase 1 Deal Priced In

- Growing Risk of a Top in the Short Term

Source: Refinitiv

DAX | Germany’s DAX Chasing All-Time High

The beginning of week had largely been characterized by risk aversion, stemming from a rise in geopolitical tensions between the US and Iran. In turn, equity markets had largely been on the backfoot. However, the initial concerns were quickly forgotten as both sides refrained from escalation tensions further and thus relief rally had propelled the DAX higher, gaining over 4% from the weekly lows. Consequently, with investors piling back into equities, Germany’s DAX is now chasing its all-time peak at 13,601.

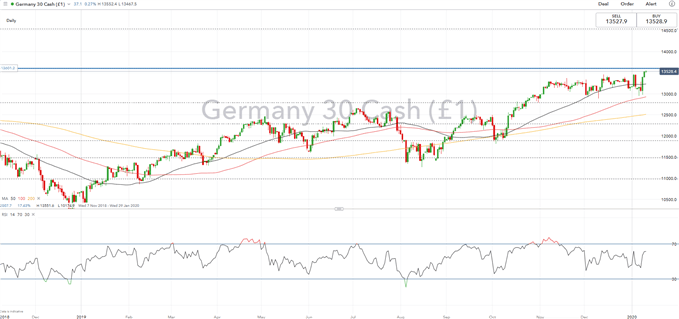

Moving Averages: 50DMA (13,232), 100DMA (12,928), 200DMA (12,512)

Phase 1 Trade Deal Expected to be Signed, However, this is Price in

As we look towards next week, with little scheduled from a Eurozone and German standpoint, other than final readings for inflation, the German DAX is likely to take its cue from the broader risk environment. As a reminder, the US and China are expected to sign the Phase 1 trade deal on January 15th. However, this has been largely priced in, therefore the impact on equity markets could be somewhat muted, unless there are concerns that the signing of the deal could be delayed.

Risk of a Top?

Amid the persistent upside across global equities, Bank of America’s Bull and Bear indicator has hit a 21-month high, consequently nearing extreme bullish sentiment. As such, they note that their indicator has provided its first sell signal since January 2018. Coincidently, this had preceded the sharp violent sell-off seen in February 2018. That said, this raises questions as to whether the DAX 30 is nearing a top in the short run.

DAX Price Chart: Daily Time Frame (Nov 2018 – Jan 2020)

Source: IG Charts

Trading the Dax 30: Trading Strategies and Tip

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX