EUR/USD Price Forecast, Analysis and Chart:

EUR/USD Trades Below 1.1100 for The First Time in Three-Weeks

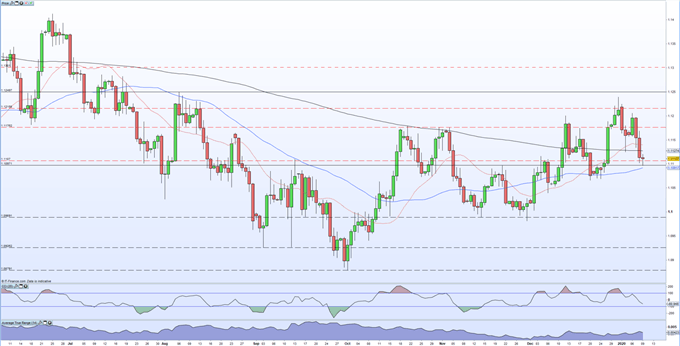

EUR/USD continues to fade lower in 2020 with the pair briefly breaking below 1.1100 before a mild pullback.

A combination of weak Euro-Zone economic data and a resurgent US dollar weighs on the pair with traders now looking ahead to Friday’s US Labor Report (Non-Farm Payrolls) for further USD guidance.The latest CoT also showed that Euro short positions continued to build, adding further pressure on the single currency.

US Dollar Longs Slashed, GBP/USD Most Bullish Since May 2018 – COT Report

The pair now trade below both the 50- and the 200-dma, a negative sign, and near the 20-dma, currently situated at 1.1092. A break lower would leave the December 20 higher low (1.1066) the next downside target and a comprehensive break of this level would increase negative sentiment for the pair and open the way to the November 29 low print at 1.0981.To the upside, a cluster of dmas and old highs up to 1.1176 may prove difficult for EUR/USD to overcome in the short-term, while the recent five-month high of 1.1240 is likely to remain untested.

EUR/USD Daily Price Chart (June 2019 – January 9, 2020)

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on the Euro and the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.