Crude Oil Analysis & News

- President Trump Threatens Further Military Action

- Iraq to Face Sanctions?

- Risk Premium to Keep Oil Prices Elevated

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | 1% |

| Weekly | 31% | -38% | 7% |

Crude oil prices gained another 2% overnight following last Friday’s spike higher with Brent crude oil hitting the highest level since September 2019 after both Iran and the US stepped up their war of words over the weekend.

President Trump Threatens Further Military Action

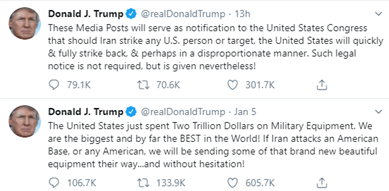

US President Trump stated that should Iran retaliate to the killing of Iranian General Qassem Soleimani the US would strike back in a disproportionate manner, in which they would target 52 Iranian sites. Consequently, Brent crude backwardation has increased as market participants price in the risk of potential supply disruptions. As it stands, focus is on how and to what extent will Iran retaliate to last week’s sharp escalation in geopolitical tensions.

Source: Twitter

Strait of Hormuz: the world’s most important oil chokepoint

Iraq to Face Sanctions?

Elsewhere, Iran stated that they would end its commitment to limit uranium enrichment as part of the 2015 nuclear deal. However, they did offer a way in which they would return to compliance, which would be if the US lifted their economic sanctions on the country. Alongside this, Iraq had voted in favour of expelling US troops from their country, which in turn saw US President Trump threaten sanctions on Iraq. Of note, they are the second largest oil producer in OPEC with an output of 4.6mbpd.

Risk Premium to Keep Oil Prices Elevated

Crude oil prices continue to trade on the front foot with Brent crude futures testing $70/bbl. That said, given the potential oil supply risks amid a retaliation from Iran, oil prices are likely to remain elevated. However, as had been highlighted from the September attacks on Saudi Arabia’s oil facilities, the market is flexible in handling supply disruptions, thus, sizeable spikes in oil prices could be somewhat short-lived.

Crude Oil Price Chart: Daily Time Frame (Aug 2019 – Jan 2019)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX