Gold Price Analysis and Talking Points

- Gold Prices Underpinned by Continued USD Pullback

- Near Term Resistance Holds, Eyes on Upside Breakout

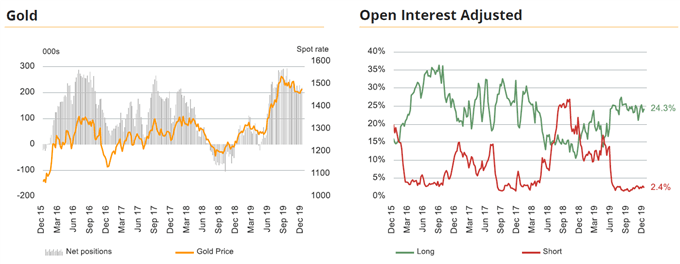

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

Gold Prices Underpinned by Continued USD Pullback

Despite US equities hovering around record highs, gold prices have maintained its recent upside amid the continued pullback in the US Dollar, with Citi FX month-end rebalancing models expecting further depreciation in the greenback. Tensions in the middle east via US airstrikes against Iranian-backed militia in Syria and Iraq have also underpinned gold prices.

Near Term Resistance Holds, Eyes on Upside Breakout

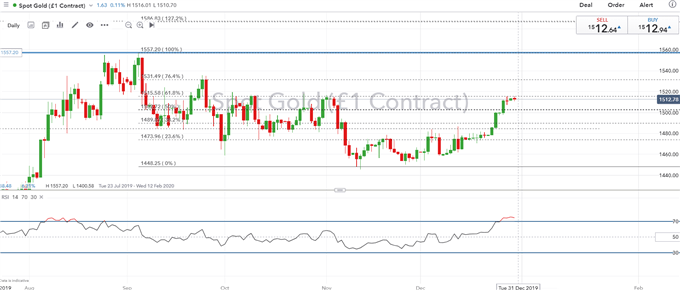

On the technical front, further upside in the precious has stalled at $1515, which marks the 61.8% Fibonacci retracement from the September peak to the November low. That said, with gold prices in overbought territory we don’t rule out a mild pullback in the short run, particularly with the US and China expected to sign off the Phase 1 trade deal within the next couple of days, according to SCMP sources. However, with January typically a strong month for gold, risks are for an upside move towards $1530 on seasonal factors.

GOLD PRICE CHART: Daily Time-Frame (Jul 2019 – Dec 2019)

Source: IG Charts

CFTC Gold Positioning (as of December 17th)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX