Gold Talking Points:

- Gold prices hit new weekly highs after the FOMC commentary turned slightly dovish

- Investor focus has shifted towards a new round of expected US tariffs to be place on Chinese goods this Sunday

- Gold prices consolidate as risk aversion ticks up

Gold prices hit a fresh weekly high on Wednesday afternoon as the FOMC decided to leave rates unchanged at their latest meeting. In the statement following the decision, Fed Chairman Jerome Powell alluded that the Federal Funds rate is likely to remain on hold throughout 2020, with a need for a notable uptick in inflation before rates can be increased. These remarks were taken by investors to be slightly dovish, which put downward pressure on the dollar and gave gold prices a lift.

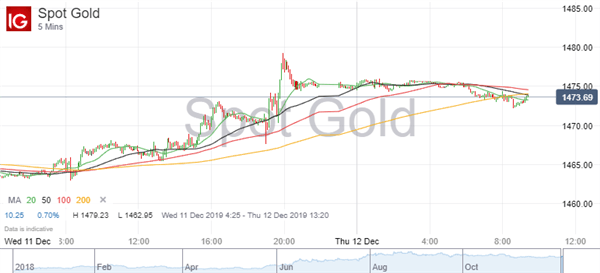

But momentum drained away in the early hours of Thursday as the deadline of the latest round of US tariffs on Chinese goods drifts closer. Gold traded in a lateral range during the Asian hours, sticking around the $1,474.5 mark, slightly down from Wednesday’s high of $1,479.2.

Risk aversion is likely to pick up towards the end of the week, as US-China trade wars remain of concern to investors. Despite an upbeat rhetoric throughout this week, the history of this ongoing trade dispute is one of unexpected surprises regarding the process of completing a deal, meaning anything can happen and investor relief is not guaranteed until a deal is signed and confirmed. If tariffs are introduced on Sunday, we expect this to provide a real push for gold prices.

5-minute Gold price chart: consolidation continues after a slight uptick post FOMC

Gold bulls will be looking for a price breakout objective above the December high of $1,484.25 as consolidation continues to head underway. On the downside, a near-term break below the December low of $1,454.17, with a key support level at $1,463.

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our Q4 forecasts to learn what will drive FX the through the quarter.

--- Written by Daniela Sabin Hathorn, Junior Analyst

To contact Daniela, email her at Daniela.Sabin@ig.com

Follow Daniela on Twitter @HathornSabin

https://www.dailyfx.com/free_guide-tg.html?ref-author=McQueen