Canadian Dollar Outlook:

- USD/CAD plummeted to 1.3173 following Wednesday’s FOMC meeting where Chairman Powell doubled down on a dovish pause

- Elsewhere, CAD/JPY trudged higher as it nears the 82.50 mark

Canadian Dollar Outlook: USD/CAD, CAD/JPY Levels Post-FOMC

The US Dollar dropped following Wednesday’s FOMC rate decision, signaling Chairman Powell’s commentary was more dovish than the market had anticipated. Consequently, USD/CAD dropped by more than 40 pips which saw the pair plummet through support around the 1.32 area. With initial support in the rearview, USD/CAD could look to continue lower as traders reassess the outlook of the Fed and its impact on the Greenback.

USD/CAD Price Chart: 4 - Hour Time Frame (August 2019 - December 2019) (Chart 1)

With that in mind, further pressure could see USD/CAD take aim at recent swing-lows from September and November around 1.3134. The area may be the final hurdle for USD bears before they look to target the longer-standing support around 1.3020. Similarly, a significant drawdown in short exposure amongst retail traders may suggest USD/CAD could continue lower although traders remain net-short.

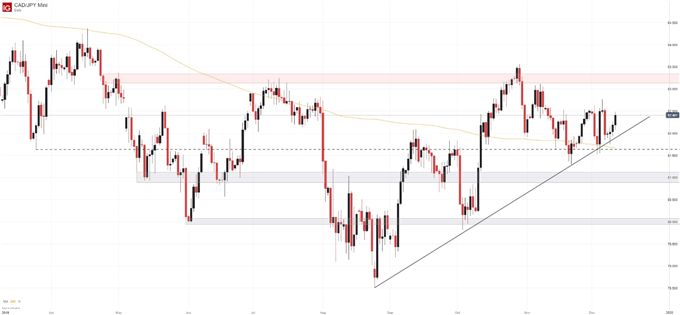

CAD/JPY Price Chart: Daily Time Frame (March 2019 - December 2019) (Chart 2)

Tangentially, CAD/JPY has enjoyed a similar bout of strength this week, ascending off confluent support around the 81.65 level where the 200-day moving average resides. If Canadian Dollar strength continues, the pair will eventually have to confront the 83.25 area which has worked to keep price contained since late April.

In the event risk aversion reemerges, or Bank of Canada Governor Stephen Poloz offers dovish commentary at his speech on Thursday, the Canadian Dollar could look to nearby support once more. To that end, 81.65 has become an area that commands significant respect from a technical perspective. Regardless, a break below the zone would see CAD/JPY take aim at subsequent support around 81.

While the longer-term trend is still lower, the pair’s ability to notch a higher high in October is an encouraging sign for bulls looking to capitalize on Canadian Dollar strength, or perhaps Yen weakness, in the weeks ahead. Nevertheless, I would like to see a second higher-high – above that of July and October – before exploring long opportunities.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Stock Market Crashes: Current Climate Compared to Prior Conditions