Japanese Yen Outlook:

- USD/JPY fell under pressure on Monday after weak economic data and trade war fears rattled markets

- Now, the pair will look for support from an ascending trendline dating back to late August

- Another avenue for potential JPY strength is CAD/JPY which could continue lower if risk aversion lingers

US Dollar Forecast: USD/JPY Sinks on Trade War Fears, Weak Data

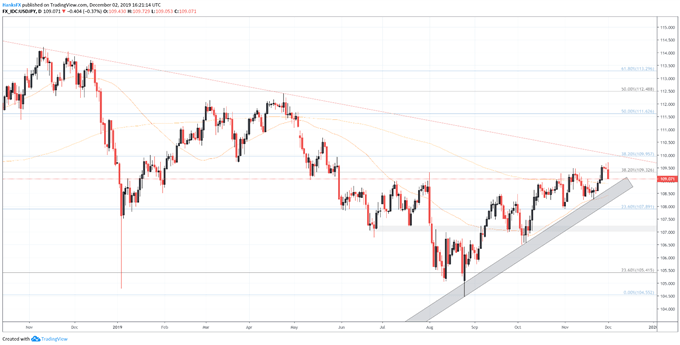

USD/JPY faltered on Monday, moving to support around the 200-day moving average and an ascending band from late August. With trade war fears and weak economic data stoking risk aversion, the US Dollar could deteriorate further in the days ahead as Fed rate cut odds readjust to the new climate. Thus, USD/JPY could threaten to break its recent uptrend if support proves insufficient.

USD/JPY Price Chart: Daily Time Frame (October 2018 – December 2019) (Chart 1)

Chart created with TradingView

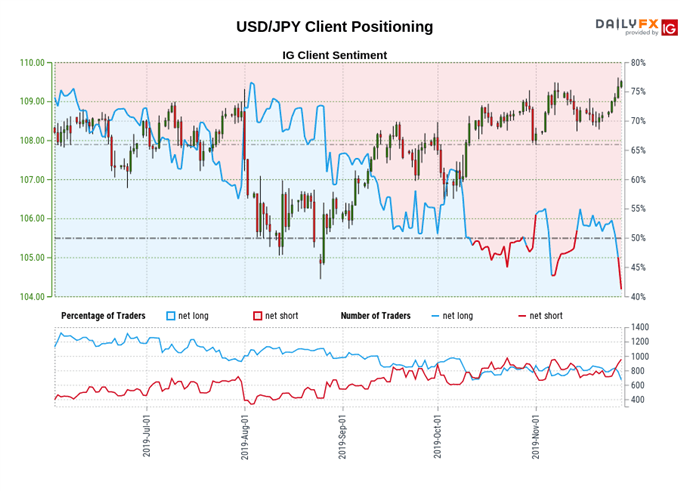

To that end, the variety of technical levels beneath serve to offer a bounty of support, but also make it difficult to identify clear cut barriers. Nonetheless, 108.50 and 107.90 may be areas of interest – roughly aligning with the 200-day moving average and a 23.6% Fibonacci level. Beyond the area of confluence, 107 could serve to offer tertiary support. While the fundamental and technical outlook look to butt heads, a recent shift in IG Client Sentiment Data suggests the minor retracement in USD/JPY is overdone and the pair could continue higher despite potential headwinds.

Retail trader data shows 41.22% of traders are net-long with the ratio of traders short to long at 1.43 to 1. The number of traders net-long is 2.14% lower than yesterday and 10.84% lower from last week, while the number of traders net-short is 11.54% higher than yesterday and 30.01% higher from last week. We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bullish contrarian trading bias.

With that in mind, a deeper shock to the fundamental landscape may be required to overwhelm technical support and pressure USD/JPY to snap its multi-month rally. To be sure, trade war developments may become the driving factor behind the pair as the deadline to the December 15 tariff deadline winds down. Until then, it seems likely technical support can keep the pair afloat.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Stock Market Crashes: Current Climate Compared to Prior Conditions