Canadian Dollar Outlook: USD/CAD Price, Analysis and Chart

- USD/CAD nears longer-term resistance.

- Retail traders are net-short USD/CAD, a bullish contrarian signal.

Brand New Q4 2019 CAD and USD Forecasts and Top Trading Opportunities

USD/CAD Chart Shows Indecision and Longer-term Resistance

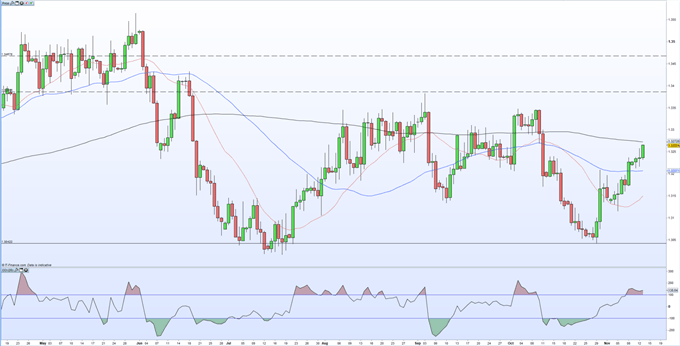

The recent push higher in USD/CAD is likely to slow, or reverse, in the short-term as the pair near longer-term chart resistance. USD/CAD currently trades around 1.3265 and is closing in on the 200-day moving average situated around 10 ticks higher. The rally off the October 29 low at 1.3042 remains in place but the longer-term ma suggests that further bullish price action may struggle unless the pair close above 1.3273. Two other indicators also suggest a slow down or reversal of recent price action with the CCI indicator currently showing USD/CAD as overbought while Tuesday’s long-legged doji also points to market indecision.

Five Doji Candlestick Patterns

For the pair to continue their upward move, a break and close above the 200-dma is required which would then open the way to the early-mid October highs situated between 1.3340 and 1.3350. IG client sentiment also shows that retail traders are net-short USD/CAD, a bullish contrarian indicator. The US dollar as a currency remains strong despite the ongoing US-China trade spat. US President Donald Trump’s said yesterday that while the two sides are close to a ‘significant phase-one deal’, he will only accept a deal ‘if it’s good for the United States’.

This afternoon’s US CPI reading may prompt a move in the US dollar, while traders should also carefully monitor US Fed Chair Jerome Powell’s testimony to the Joint Economic Committee of Congress at 16:00 GMT.

USD/CAD Daily Price Chart (April – November 13, 2019)

IG Client Sentiment shows that traders are 59% net-shortUSD/CAD, a bullish contrarian bias.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on the Canadian Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.