NFP Analysis and Talking Points

- US Nonfarm Payrolls rose by 128k in October, above expectations of 89k; Prior month revised higher to 180k

- US Average Hourly Earnings broadly in line with consensus

NFP Report Review

US Bureau of Labor Statistics reported total nonfarm payroll (NFP) employment expanded by a 128k jobs in October, beating expectations of 89k. Alongside this, the headline figure for the prior month saw an upward revision to 180k from 136k. Elsewhere, the unemployment rate saw 0.1ppt rise to 3.6%, matching consensus with the uptick associated with the increase in the labour force participation rate.

Wage Growth Remains Muted

The Fed focussed wage data missed analyst estimates on the monthly reading, which showed a 0.2% rise vs Exp. 0.3%, while the yearly at rose 3%. That said, with inflationary pressures remaining somewhat muted, this is likely to keep the Fed on a relatively cautious trail.

Market Response

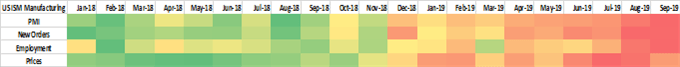

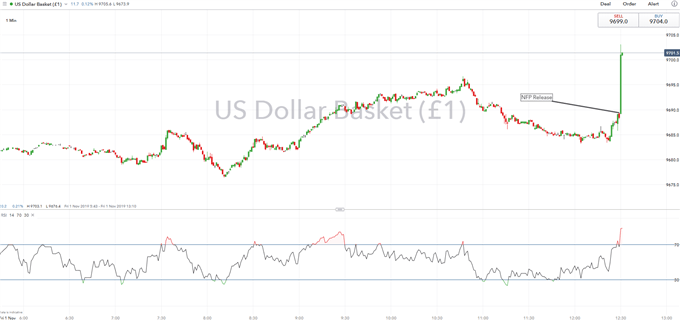

The robust jobs reports saw a firmer US Dollar across the board, while US Treasury yields also edged slightly higher with the 10yr yield breaking above 1.7%. Consequently, gold prices dipped lower with the precious metal making testing $1500. However, eyes now turn towards the ISM Manufacturing PMI, which has in recent months sparked greater volatility than the NFP print.

ISM Manufacturing PMI Heatmap

USD Price Chart: 1-minute time frame (Intra-day)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX