NFP Analysis and Talking Points

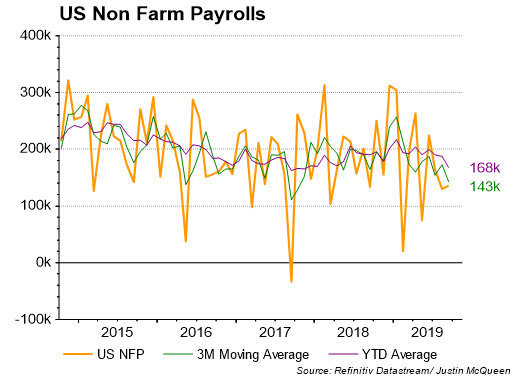

- US Nonfarm Payrolls rose by 136k in September, below expectations of 145k; Prior month revised higher

- US Average Hourly Earnings fell short of consensus

- NFP data enough to calm recession fears but still weak enough to keep markets pricing in Fed rate cuts

DATA RECAP

US NFP 136k vs. Exp. 145k (Prev. 130k, Rev. 168k)

Unemployment Rate 3.5% Exp. 3.7% (Prev. 3.7%)

Average Earnings M/M 0.0% Exp. 0.3% (Prev. 0.4%)

Average Earnings Y/Y 2.9% Exp. 3.2% (Prev. 3.2%)

NFP Report Review

US Bureau of Labor Statistics reported total nonfarm payroll (NFP) employment expanded by 136k jobs in September, missing expectations of 145k. Alongside this, the headline figure for the prior month saw an upward revision to 168k from 130k, while the unemployment rate saw a surprise 0.2ppt drop to 3.5%.

Wage Growth Eases

Wage data missed analyst estimates with the monthly reading at 0.0% vs Exp. 0.3%, which pushed the yearly rate down to 2.9% from 3.2%. Overall, in light of the recent soft US data, in particular the ISM Manufacturing and Non-Manufacturing PMI, the NFP report has eased fears of an imminent recession, however, the data is still weak enough to keep markets pricing in rate cuts from the Federal Reserve and also highlights that the jobs market is slowing.

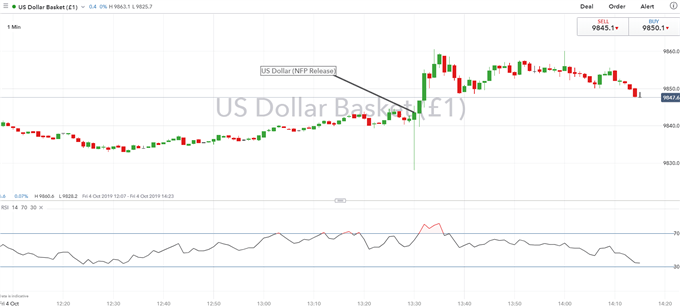

Market Response

While the NFP headline had been lower than expected, markets had been much more pessimistic given the recent US data, thus a relatively small miss on expectations had been enough to prompt a modest lift in the greenback. That said, the data remains weak enough for Fed Fund Futures to price in another rate cut in October. Going forward, the next key input on the US data front will be the retail sales on October 16th.

USD Price Chart: 1-minute time frame (Intra-day)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX