Oil Price Analysis and News

- Crude Oil Prices Boosted by New Saudi Energy Minister

- Trade Wars Presents Downside Risks

- JMMC Meeting

Crude Oil Prices Boosted by New Saudi Energy Minister

Crude oil prices extended its recent winning streak with Brent crude futures trading at roughly 6-week highs. While the improved risk sentiment amid Chinese policy easing has underpinned prices in recent sessions, the latest catalyst had stemmed from the appointment of the Saudi King’s son, Prince Abdulaziz bin Salman, as the new energy minister. Markets reacted positively to this announcement on hopes that production cuts could be extended, particularly following comments from the Prince that the OPEC+ alliance will be in place for the long term. That said, Prince Abdulaziz is expected to face mounting pressure from Saudi royals in order to boost oil prices to help reduce current budget constraints and to also lift the value from the partial privatisation of Saudi Aramco, which plans to list 1% of Aramco this year.

Trade Wars Presents Downside Risks

However, while oil markets have reacted positively to the potential of an extension of current OPEC cuts, the challenges for the oil market remains on the demand side amid the slowdown in the global economy stemming from US-China trade wars. Subsequently, this has prompted Goldman Sachs to yet again lower their 2019 oil demand growth to 1mbpd from 1.1mbpd, therefore a possible escalation of trade wars continues to pose downside risks to the oil market. Of note, the OPEC monthly report is scheduled to be released on September 11th.

JMMC Meeting

Elsewhere, market participants will be looking towards the latest JMMC meeting, which will take place on September 12th. While a decision pertaining to an extension of production cuts is not expected, the OPEC Secretary General did that the JMMC may discuss new metrics the for current global oil cuts.

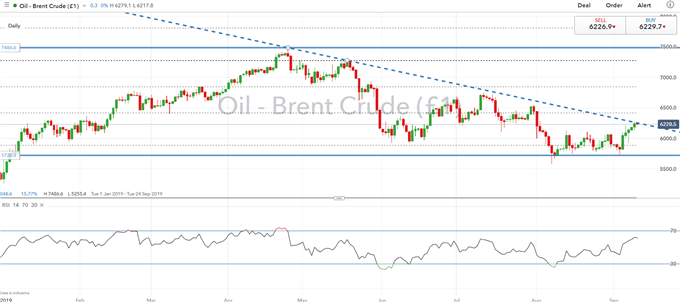

Brent Crude Price: Daily Time Frame (Jan 2019 – Sep 2019)

On the technical front, trendline resistance from the 2019 peak has curbed further upside for now. Although, with US APIs scheduled later today and with tomorrows DoE report expected to show a 4th consecutive drawdown in stockpiles, this could push Brent crude futures through resistance and open the doors for a test of $65, providing APIs show a sizeable drawdown. On the downside, support resides at the psychological $60 handle.

Oil Impact on FX

Net Oil Importers: These countries tend to be worse off when the price of oil rises. This includes, KRW, ZAR, INR, TRY, EUR, CNY, IDR, JPY

Net Oil Exporters: These counties tend to benefit when the price of oil rises. This includes RUB, CAD, MXN, NOK.

Recommended Reading

What Traders Need to Know When Trading the Oil Market

Important Difference Between WTI and Brent

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX