Jackson Hole Talking Points:

- Fed Chair Jerome Powell’s speech behind closed doors at the Jackson Hole Economic Policy Symposium has neither surprised nor disappointed market participants.

- In saying “we will act as appropriate to sustain the expansion,” Fed Chair Powell has more or less confirmed that markets are correct in anticipating another rate cut in September.

- The US Dollar declined slightly after Fed Chair Powell’s remarks, with US equities rallying and gold prices falling back slightly.

See Q3’19 forecasts for the US Dollar, Euro, British Pound and more with the DailyFX Trading Guides

Federal Reserve Chair Jerome Powell's speech at the Jackson Hole Economic Policy Symposium can't be considered anything other than a 'dud.' The ballyhooed speech, on the heels of topsy turvy month in financial markets thanks to twists and turns in the US-China trade war, provided neither relief nor repression for market participants seeking clarity over the near-term rate cut path.

Saying the US economy faces "significant risks," Fed Chair Powell made clear that the FOMC will not be able to fully offset the impact of the US-China trade war, but will "act as appropriate to sustain the expansion."

Noting that "monetary policy has no rulebook" for trade, Fed Chair Powell clearly wanted to give the FOMC plenty of wriggle room - policy optionality, if you will - to adjust course in the event of unexpected developments in the US-China trade war.

The milquetoast speech was more or less in line with expectations ahead of time, as rates markets were only pricing in a 2% chance of a 50-bps rate cut at the September Fed meeting.

Read more: US Dollar Looks to Jackson Hole for Fed Rate Cut Clues - Central Bank Weekly

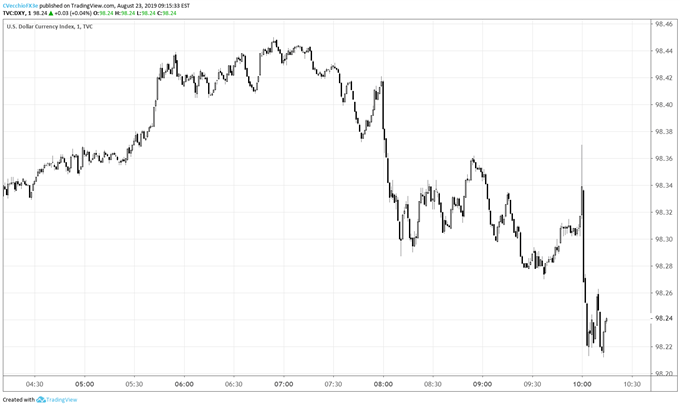

US Dollar (DXY Index) Technical Analysis: 1-minute Price Chart (August 23, 2019 Intraday) (Chart 1)

Following the release of Fed Chair Powell’s pre-scheduled remarks, the DXY Index initially gained ground from 98.32 to as high as 98.37 thereafter. However, at the time this report was written, the DXY Index was trading slightly lower, at 98.24. Needless to say, market participants are neither surprised nor disappointed with Fed Chair Powell – as was anticipated in the Jackson Hole preview.

Read more: Gold Prices Maintain Uptrend, Eye Continuation Effort Around Jackson Hole

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX