MARKET DEVELOPMENT –CHINA ANNOUNCE RETALIATORY TARIFFS ON US GOODS

DailyFX 2019 FX Trading Forecasts

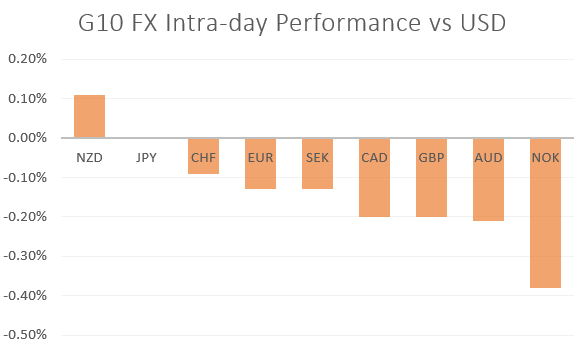

Trade War Latest: In response to Trump’s decision to break the trade war ceasefire at the back end of July, China have announced retaliatory tariffs, in which China will levy 5-10% on $75bln of US goods from September 1st and December 15th. Consequently, equity markets have pulled back with the Dow Jones dropping to session lows, while safe-haven assets, most notably the Japanese Yen and Gold had been underpinned. Alongside this, in regard to individual products, China will place 5-10% tariffs on US crude oil, which in turn has seen oil prices plunge over 2% in reaction to the announcement.

USD: Aside from the latest trade war escalation, focus will be on Fed Powell’s Jackson Hole Symposium speech. So far, the rhetoric from Fed officials have tilted slightly on the hawkish side, relative to market expectations. Yesterday, Fed’s George stated that she would be happy to leave rates where they currently are, while Harker noted that the Fed are roughly at neutral. Alongside this, Fed’s Kaplan said he would like to avoid taking further action on interest rates. As such, given that money markets are pricing in 53bps worth of easing by the end of the year and an additional 47bps by the end of 2020, the bar has been set high for Fed Chair Powell to meet those dovish expectations, particularly given the comments that have come from Fed officials already.

Source: DailyFX

WHAT’S DRIVING MARKETS TODAY

- “Crude Oil Price Forecast: Watch for Battle at Resistance to Resolve Lower” by Paul Robinson, Currency Strategist

- “GBPUSD Price: Giving Back Gains Ahead of Fed Powell’s Speech” by Nick Cawley, Market Analyst

- “US Dollar Outlook: GBPUSD, USDJPY Price Action on Fed’s Powell” by Justin McQueen, Market Analyst

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX