Eurozone PMIs and EURUSD Price, Chart and Analysis:

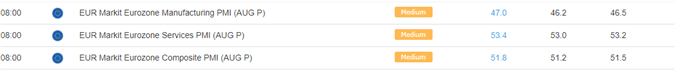

- Eurozone PMIs beat expectations but remain lowly.

- German new orders decline by the fastest rate since April 2013.

Q3 2019 EUR and USD Forecasts andTop Trading Opportunities

Keep up to date with all key economic data and event releases via the DailyFX Economic Calendar

The recent soft patch in the eurozone economy continued into August, according to the latest batch of Markit PMIs, although all reading beat expectations to the upside.

According to Andrew Harker at Markit, ‘The dynamics of the Eurozone economy were little changed in August with solid growth in services continuing to hold the wider economy’s head above water despite ongoing manufacturing decline…we are still looking at (Eurozone) GDP only rising by between 0.1% and 0.2%, based on PMI data for the third quarter’.

While France pushed ahead, German new orders fell to the greatest extent in over six years and firms were pessimistic around the future path for activity. According to Harker, ‘the risk remains, therefore, that the euro area’s largest economy will have fallen into technical recession in the third quarter’.

EURUSD hardly moved post-release and continues to trade either side of 1.1100 with little inclination to make a sustained break. Traders will likely be waiting for Friday’s speech by Fed chair Jerome Powell at the Jackson Hole Symposium, after last night’s FOMC minutes provided little in the way of guidance. The daily chart shows this week’s ultra-tight trading range and no clear short-term direction for the pair. Traders will hope that Friday’s speech by Powell will break the recent prohibitive trading range.

EURUSD Daily Price Chart (November 2018 – August 22, 2019)

IG Client Sentiment data shows traders are 67.6% net-long EURUSD, a bearish contrarian bias. However current sentiment and recent changes give us a stronger bearish EURUSD trading bias.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.