MARKET DEVELOPMENT – GBP/USD Dips, EUR/USD Eyes Italy, AUD/USD Bounces on RBA

DailyFX 2019 FX Trading Forecasts

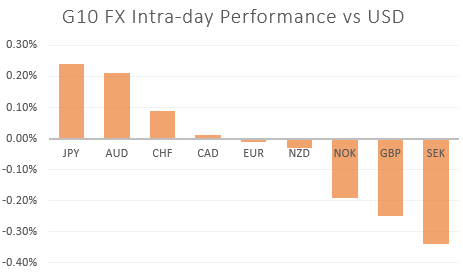

GBP: A lack of compromise between the UK and the EU provides another reminder that corrective moves higher in the Pound will be faded. The Pound dipped below 1.21 against the greenback as UK PM Johnson’s letter demanding the reopenining of the withdrawal agreement had been rebuffed by the EU, in which they stated that Boris Johnson had not provided a viable proposal in regard to an alternative to the Irish backstop.

EUR: Italian politics will take center stage for the Euro with Prime Minister Conte set to face a no-confidence after he addresses the Senate from 1400BST.If PM Conte loses the no-confidence or resigns before the vote takes place, President Matttarella will have two options. Either gather party leaders in order to form a technocratic government with the sole purpose of passing the 2020 budget (due October 15th) or call for snap elections, which could take place as soon as the Autumn (most bearish scenario). (Full analysis)

AUD: Latest RBA meeting minutes offered a slightly more balanced approach with rate setters stating that developments in regard to the domestic and global economy would need to be assessed before mulling further easing. Consequently, the Australian Dollar is slightly firmer with expecations of near-term easing receeding. As it stands, money markets attach an 88% likelihood that interest rates will be left on hold at 1% at the September meeting.

Source: DailyFX

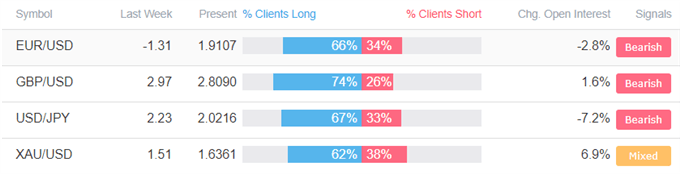

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “Gold Price and Silver Outlook Remains Constructive So Far” by Paul Robinson, Currency Strategist

- “GBPUSD Price Outlook Fragile as Boris Johnson Heads to Europe” by Nick Cawley, Market Analyst

- “EUR/CHF Outlook: SNB Steps up Currency Intervention” by Justin McQueen, Market Analyst

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX