Gold & Silver Price Analysis and Talking Points:

- Gold Price Outlook Remains Bullish

- Silver Prices Slightly Outperforming Gold

See our quarterly gold forecast to learn what will drive prices throughout Q3!

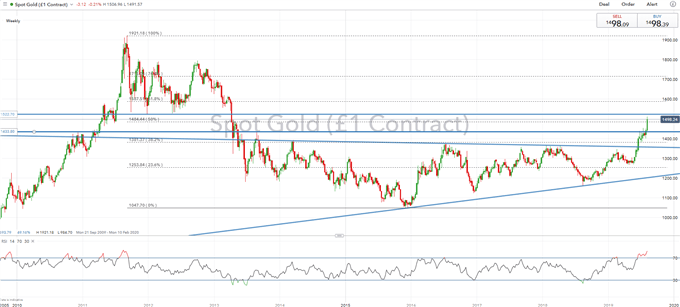

Gold Price Outlook Remains Bullish

Despite the US Dollar holding up relatively well in recent sessions, gold prices have continued to extend on its gains, hitting fresh 6yr highs at $1500 amid the plunge in global bond yields. As the drop-in bond yields persist, the opportunity cost of holding gold continues to diminish. However, given the size of the move in gold in recent sessions, there is a potential risk of slight exhaustion, thus making the risk reward for a further move higher at current levels slightly less attractive. As such, eyes will be on for a potential pullback for a better opportunity to have a bullish bias. That said, the medium-term outlook continues to remain bullish for the precious metal as the Federal Reserve continue to ease policy, while trade war tensions weigh on economic performance. Topside targets would be for a break of $1522 to open a move towards $1550.

GOLD Technical Levels

Resistance 1: $1522 (Triple Bottom)

Support 1: $1433 (August 2013 High)

Support 2: $1381 (38.2% Fib)

GOLD PRICE CHART: Daily Time-Frame (Sep 2009 -Aug 2019)

What You Need to Know About the Gold Market

Silver Price Outlook | Slightly Outperforming Gold

Silver prices have surged higher following a clean break of the descending trendline stemming from the November 2016 peak. In turn, this has seen silver prices push through the $17 level. Silver has continued to outperform gold prices as the gold/silver ratio heads lower, albeit ever so slightly. On the technical front, topside resistance resides at $17.54, which marks the 50% fib from the 2016 peak to the 2018 low. While a slight negative divergence on the RSI raises the risk of a slight pullback.

Silver Price Chart: Daily Timeframe (Oct 2018 – Jul 2019)

GOLD TRADING RESOURCES:

- See our quarterly gold forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX