AUD/USD, China Trade Surplus, Trade Wars Talking Points

- Australian Dollar looks past growth-supportive Chinese trade data

- Rising US-China trade tensions is a clear downside AUD/USD risk

- Bounce in the Aussie may be corrective, Hammer shows indecision

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

China Trade Balance Surprise Indicates Better Outcome for Economic Growth

The Australian Dollar, the markets go-to liquid China proxy, looked past supportive Chinese trade data. In July, exports out of China (in USD terms) unexpectedly increased by 3.3% y/y versus -1.0% anticipated. Meanwhile, imports contracted less-than-expected at -5.6% compared to -7.3% in June. Combining the two made for a trade surplus of $45.06b, much higher than the $42.65b estimate but down from $50.98b prior.

What this means for China is a more supportive outcome for local growth. Subtracting imports from exports yields you the trade balance, which is one of the four components of GDP. A positive outcome may add to growth. However, the Australian Dollar and equities showed a tepid reaction to the data as trade relations between the world’s largest economies risk souring.

Hours earlier, the People’s Bank of China set the Yuan reference rate at 7.0039 per USD which was the first time since 2008 a level above 7.00 was set. While this was lower than the 7.0156 estimate, it could risk fueling tensions with Washington. US President Donald Trump frequently accuses China of currency manipulation. Earlier this week, the US Treasury Department labeled China as a currency manipulator.

With Trump ready to impose 10% tariffs on about $300b in Chinese imports come September, there is a risk that the levy could rise to perhaps 25%. This is because a weaker Yuan can offset the higher cost that US consumers can expect from the tariffs, aiding to negate their impact as a higher tax and perhaps leading to retaliation. Rising trade tensions can add scope for the RBA to ease, weakening AUD/USD.

AUD/USD Technical Analysis

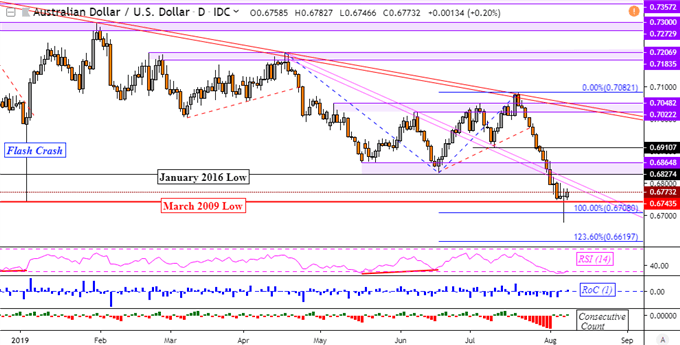

For the time being, the bounce in the AUD/USD seems corrective given recent prolonged weakness. Prices were unable to close below March 2009 lows, leaving a Hammer candlestick. This is a sign of indecision and with technical confirmation, could precede a turn higher. Near-term resistance appears to be a descending channel from the middle of April – pink parallel lines on the chart below.

AUD/USD Daily Chart

Australian Dollar Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how AUD is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter