Brexit News and Sterling (GBP) Price, Chart and Analysis:

- GBPUSD fading lower, nears fresh 27-month low.

- EU says UK’s new Brexit demands are ‘unacceptable’.

Q3 2019 GBP Forecast andTop Trading Opportunities

Sterling (GBP) on the Backfoot, EU on the Front Foot

The British Pound is moving lower going into the weekend and has given back all the limited Boris Johnson ‘bounce’ seen in the middle of the week. While the PM has packed his new cabinet with hardline Brexiteers and made voiced loudly that the EU must change their negotiating stance otherwise the UK will leave without a deal on October 31, the EU has not flinched. The EU’s chief negotiator Michel Barnier said that the UK’s demand to remove the Irish backstop was unacceptable and added that the tone of PM Johnson’s speech was ‘rather combative’.While this backdrop remains, Sterling will continue to fade lower.

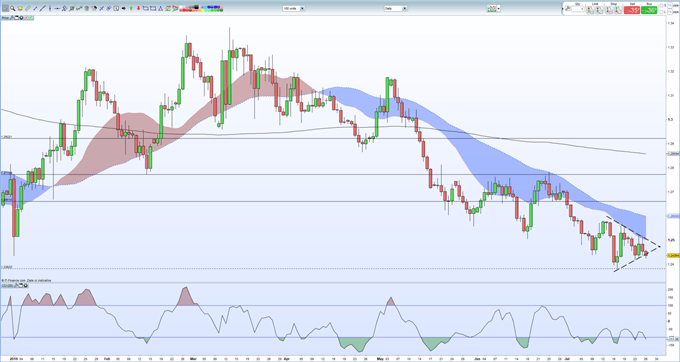

A look at the daily chart shows the technical picture also starting to break down, with the previously mentioned symmetrical triangle now looking at a potential breakout to the downside. The pair currently trade on the uptrend line and a break and close below this should open a re-test of the recent low at 1.2382. GBPUSD is just moving into oversold territory, using the CCI indicator, and this may act as a brake to any move lower.

All of this ahead of next week’s Bank of England ‘Super Thursday’, a potent combination of monetary policy decisions and inflation data. Keep up to date with all key economic data and event releases via the DailyFX Economic Calendar

GBPUSD Daily Price Chart (December 2018 – July 26, 2019)

Retail traders are 78.0% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. However recent daily and weekly positional changes give us a stronger bearish contrarian GBPUSD trading bias.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on GBPUSD – bullish or bearish? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.