EURUSD Price, Chart and Analysis:

- Will the recent EURUSD 1.1200 ‘floor’ hold?

- ECB likely to prime markets for additional monetary loosening on Thursday.

Q3 2019 EUR Forecast and USD Top Trading Opportunities and Forecasts

ECB and Data Releases Will Steer the Euro

A quiet start to the week with little data for traders to use, but the Euro this week could see recent trading ranges broken as the ECB primes itself to boost the ailing Euro-Zone economy.Along with the latest ECB monetary policy meeting on Thursday, where future rate cuts are expected to be discussed, PMI data on Wednesday is expected to show that the economy remains in a parlous state, especially the manufacturing sector. The Euro-Zone manufacturing PMI is expected to remain unchanged at 47.6 in July. A reading under 50 represents contraction compared to the previous month.

Keep up to date with all key economic data and event releases via the DailyFX Economic Calendar

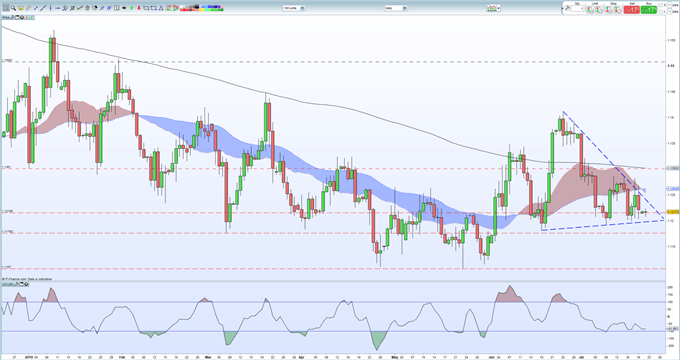

EURUSD has been trading in a triangular set-up since mid-June and the price is now heading towards a breakout as trendlines converge. To the downside, recent lows between 1.1203 and 1.1182 may be vulnerable to any sell-off, leaving the way clear to a fall back towards 1.1107, a low last seen in May 2017. The current downtrend suggests resistance starts around 1.1240, while the 20- and 50-day moving averages are situated either side of 1.1255 and may stall any further upside.

EURUSD Daily Price Chart (December 2018 – July 22, 2019)

Retail traders are 69.0% net-long EURUSD according to the latest IG Client Sentiment Data, a bullish contrarian indicator. However recent daily and weekly positional changes give us a stronger bearish contrarian trading bias.

We run several Trader Sentiment Webinars every week explaining how to use IG client sentiment data and positioning when looking attrade set-ups. Access the DailyFX Webinar Calendar to get all the times and links for a wide range of webinars.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on EURUSD – bullish or bearish? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.