Crude Oil Price & Iran Tanker Seizure in Strait of Hormuz – Talking Points

- Stena Impero, a British-flagged oil tanker, has been seized by Iran’s Revolutionary Guard in the Strait of Hormuz

- The incident comes after escalating tensions between Iran and the US following an Iranian drone being shot down by US warships in the area earlier this week

- Iranian officials confirm a second ship, the Mesdar, has also been seized in the Strait

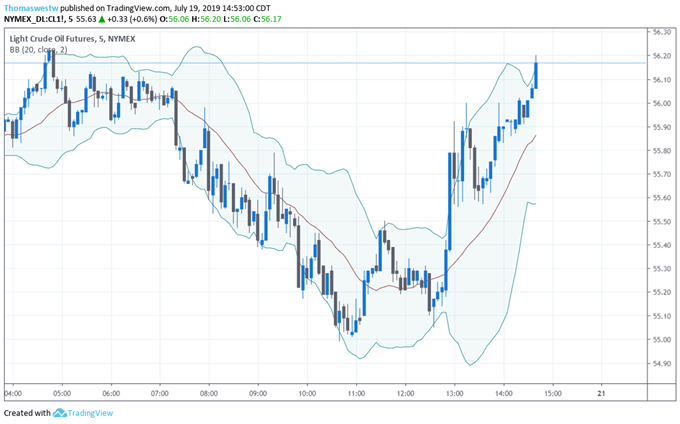

Crude oil futures are climbing after Iran’s Revolutionary Guard has seized two oil tankers in the Strait of Hormuz – one a British-flagged ship and a second ship flying under a Liberian flag. Crude oil futures climbed from $55.01 to $56.17 as news of the seized oil tankers crossed the wires. Oil remains off its recent high of $60.94 set on July 11th as global growth fears continue to weigh on the commodity. Data reported by the Energy Information Administration showed a fifth consecutive week of Crude inventory draws on Thursday, which did little to stem losses in crude oil prices as trading came to a close on Friday, marking the commodity’s worst weekly performance since May.

Crude Oil Futures Price Chart: 5-Minute Time Frame

Tensions have been high in the region for months since the US withdrew from a nuclear accord with Iran in May and then shortly after dispatched a carrier strike group to the region in a show of force towards Iran. However, Friday’s incident in the Strait of Hormuz may be an act of retaliation towards the UK specifically after British Royal Marines seized the Panamanian-flagged ship, Grace One, several weeks ago. The ship was believed to be transporting Iranian oil in violation of EU sanctions. The UK’s Defense Minister has called an emergency briefing, which is currently underway, with British MP Jeremy Hunt reportedly in attendance after saying he is “extremely concerned” by the situation.

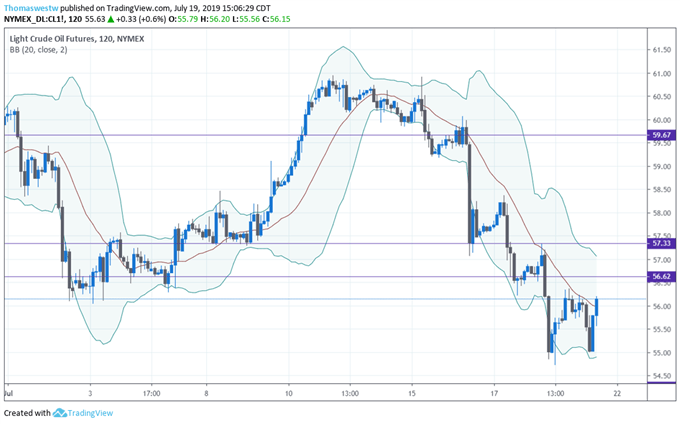

Crude Oil Futures Price Chart: 2-Hour Time Frame

Oil prices have performed considerably poorly as of late despite tensions in the Strait of Hormuz given the supply-shock risks as the region is considered to be one of the most vital sea routes for oil tankers.

As for demand, worries seem to be giving investors a pause on the commodity as trade tensions and concerns about economic growth slowdowns begin to reemerge – specifically in China and the Eurozone. The Federal Reserve has also taken notice, citing trade tensions as crosscurrents to global economic growth.

--Written by Thomas Westwater, Intern Analyst for DailyFX.com

Contact and follow Thomas on Twitter @FxWestwater

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.