GBPUSD Analysis and News

- GBP Remains Soft as Service Sector Nears Stagnation

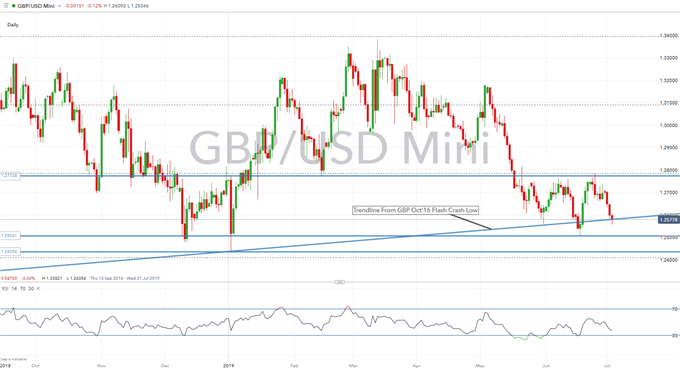

- GBPUSD Outlook: Flash Crash Trendline Holds for Now

Check out our Fundamental and Technical Q3 forecast guide for GBPUSD

GBP Remains Soft as Service Sector Nears Stagnation

GBP remains on defensive across the board with GBPUSD hovering around session lows, while EURGBP continues to edge higher as UK services PMI dropped to 50.2, missing expectations of 51. Consequently, the composite figure fell into contractionary territory at 49.7, which marked the lowest reading since the immediate aftermath of the Brexit referendum. In turn, IHS Markit stated that the combined PMI surveys indicate that Q2 growth could show a contraction of 0.1%. As such, this is likely to confirm BoE Governor Carney’s recent comments that Q2 growth is set to be considerably weaker. Thus, the outlook for the Pound remains tilted on the downside, particularly with the Bank of England providing a more cautious outlook. Of note, the next GDP release is scheduled for July 10th, however, keep in mind that this is a monthly reading for May.

GBPUSD Outlook: Flash Crash Trendline Holds for Now

As political and economic risks keep the Pound on the backfoot, the trendline stemming from the Sterling October 2016 flash has continued to support the currency. However, with downside pressures continuing to mount, eyes are on for a break below, which could exacerbate further losses in the pair with a move towards the 1.25 handle possible, before the YTD low (1.2435)

GBPUSD PRICE CHART:DAILY TIME FRAME (Sep 18 – Jul 19)

What Does Positioning Tell us About the Direction in GBPUSD?

Data shows 76.3% of traders are net-long with the ratio of traders long to short at 3.22 to 1. In fact, traders have remained net-long since May 06 when GBPUSD traded near 1.29202; price has moved 2.6% lower since then. The percentage of traders net-long is now its highest since Jun 21 when GBPUSD traded near 1.27426. The number of traders net-long is 9.3% higher than yesterday and 14.8% higher from last week, while the number of traders net-short is 11.1% lower than yesterday and 1.9% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPUSD-bearish contrarian trading bias.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX