Reserve Bank of Australia Governor Lowe, Canberra Panel Comments, Talking Points:

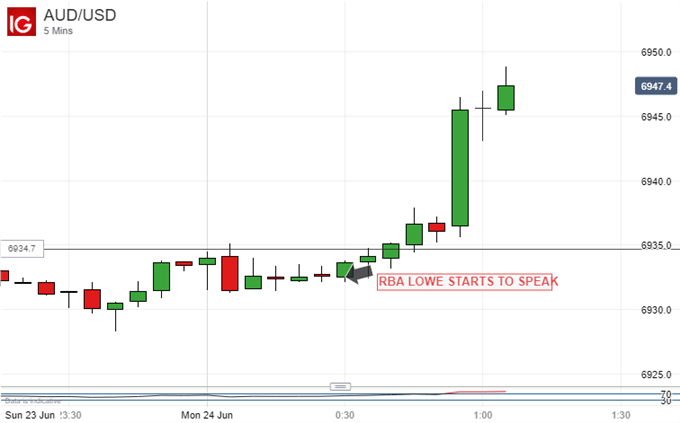

- AUD/USD rose as Lowe spoke

- He noted widespread economic gloom but pointed to the limitations of monetary policy

- He also suggested more government stimulus in the shape of infrastructure spending

Join our analysts for live, interactive coverage of all major economic data at the DailyFX Webinars. We’d love to have you along.

The Australian Dollar rose Monday after Reserve Bank of Australia Governor Philip Lowe appeared once again to ponder the limits of monetary policy’s effectiveness.

Speaking on a panel in Canberra, Lowe noted that the global economy had slowed and that risks were to the downside still. However he said that it was ‘legitimate to ask’ how effective more monetary easing would be globally and that if everyone is easing, exchange rate effects are offset. In a nutshell cutting Australian rates won’t help boost inflation by weakening the currency if rates head lower in Australia’s trading partners too.

Lowe also said that more infrastructure investment would benefit the Australian economy.

Australian interest rates were cut to a new record low this month, and futures market pricing suggests expectations that the easing process will continue.

The Australian Dollar gained after Lowe spoke, as he appeared to reinforce the message that the bar to deep rate cuts may very well be higher than the markets now think.

Central bankers around the world have largely kept monetary policy extremely accommodative since the end of the financial crisis. Clearly if long periods of record low interest rates have failed to spur pricing power, it is indeed legitimate to ask whether even lower rates would do the trick.

Lowe also flagged up European banks as a potential weak spot in the world economy. The Eurozone banking sector is fragmented and progress towards some sort of banking union has been glacial at best.

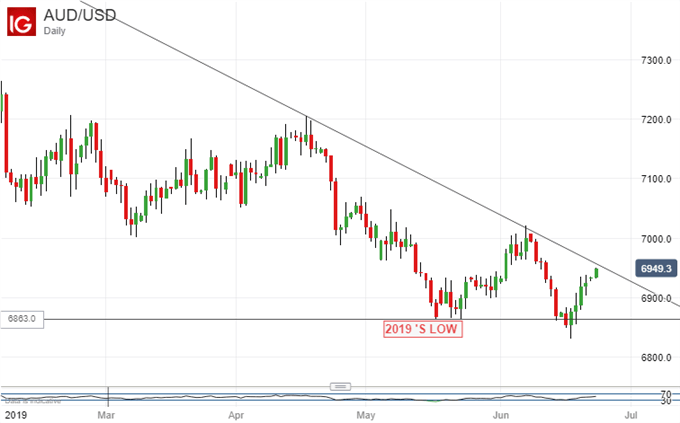

On its daily chart AUD/USD has bounced quite convincingly from its June lows but clearly remains under pressure. The long-term downtrend from early 2018 remains very much in place and the pair seems to be losing momentum before its previous significant peak.

The market clearly sees very little interest-rate support for the Aussie despite Lowe’s warnings that monetary policy cannot be the sole means of economic stimulus.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!

https://www.dailyfx.com/webinars?re-author=Cottle