GBP Analysis and Talking Points

- Wage Growth Pick-Up Emboldens Recent BoE Hawkish Rhetoric

- Unemployment Rate Continues to Hold 44yr Low

DATA RECAP

Claimant Count 23.2k Exp. 22.9k (Prev. 24.7k, Rev. 19.1k)

Unemployment Rate 3.8% Exp. 3.8% (3.8%)

Employment Change 32k Exp. 10k (Prev. 99k)

Average Weekly Earnings 3.1% Exp. 3.0% (Prev. 3.2%, Rev. 3.3%)

Average Weekly Earnings (Ex-Bonus) 3.4% Exp. 3.1% (Prev. 3.3%)

Wage Growth Picks Up

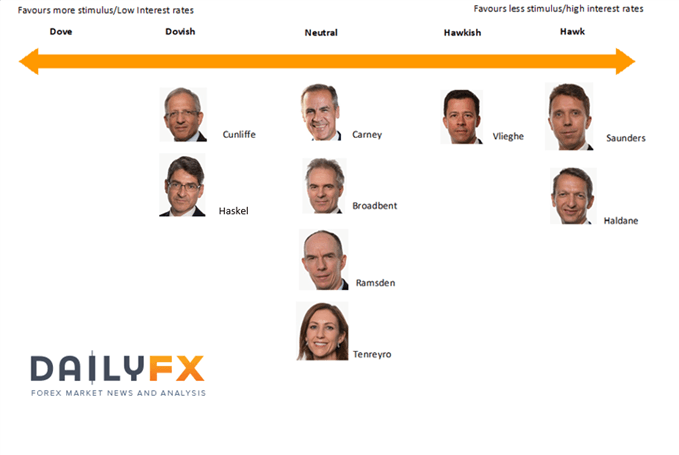

UK wages had risen faster than analyst expectations with the three months to April at 3.1% (Exp. 3%), while the ex-bonus component had increased by 3.4% (Exp. 3.1%), which had been boosted by a 3.8% annual jump in April (largest since May 2008). Consequently, this will likely embolden the hawkish rhetoric put forward recently by BoE’s Haldane and Saunders.

Employment Review

UK employment growth had slowed in April, albeit not as much as expected with employment growth at 32k (Exp. 10k). Perhaps more importantly, the jobless rate has remained at 44-yr lows, which in turn continues to suggest that the UK labour market remains robust.

Market Response

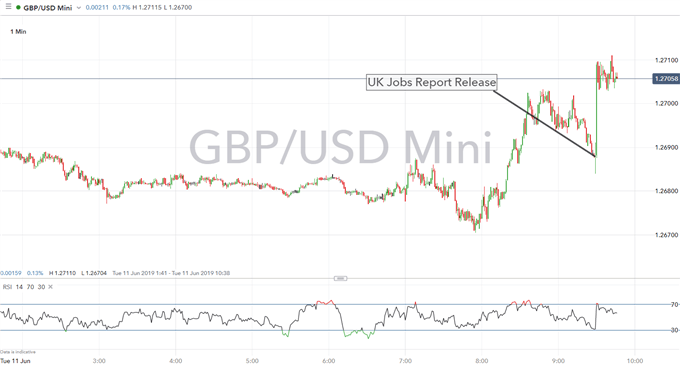

In response to the better than expected UK jobs report, GBPUSD reclaimed the 1.27 handle having jumped a marginal 15pips upon the release, while EURGBP edged back towards the 0.8900 level. However, while this may support the hawkish case put forward in recent days by Haldane and Saunders, given the political uncertainty regarding Brexit, it is still a stretch to believe that the BoE will be able to deliver a rate rise in 2019.

GBP/USD PRICE CHART: 1-Minute Time-Frame (Intra-day)

RECENT HAWKISH BOE RHETORIC

Haldane: BoE nearing time it will raise rates to keep inflation pressures in check

Saunders: BoE will probably need to return to neutral policy stance sooner than market expects (markets expecting cuts currently)

Source: DailyFX

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX