Gold Price Analysis and Talking Points:

See our quarterly gold forecast to learn what will drive prices throughout Q2!

Gold Prices Elevated on Further Trade Escalation

Following a surprise move by President Trump to impose 5% tariffs on all Mexican goods, risk sentiment has once again been rattled with equity markets taking a fresh leg lower, most notably auto stocks with exposure to Mexico. Alongside this, China had also stepped up their trade war rhetoric with reports further hinting that China could place an export ban of rare earth materials (full story). In turn, the uncertainty regarding trade wars has spilled into the real economy with Chinese Manufacturing PMI falling into contractionary territory overnight.

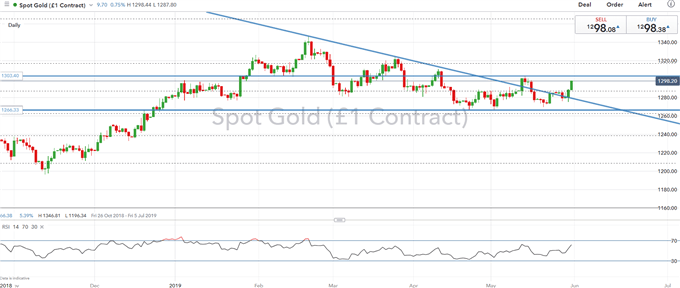

As such, safe-haven assets have been on the front foot with gold prices edging higher once again and now at the highest level in 2-weeks. However, key resistance in the form of the 100DMA at $1296 has held firm for now. Consequently, with the deterioration in risk sentiment keeping gold prices elevated, eyes will be on for a push higher and a closing break above the May peak ($1303) to extend the current bullish momentum.

Has the Fed Paved the Way for a Rate Cut?

The current mantra from the Federal Reserve is that they will maintain interest rates and remain patient in doing so given that the US economy is still in a “good place”. However, there seems to be a sizeable disconnect between the Fed’s current stance and the bond market. The 3-month-10yr US yield curve is the most inverted since the financial crisis, while Fed Fund Futures are currently pricing in over 60bps worth of easing. To add to this, 5Y5Y inflation expectations have dropped to levels not seen since the beginning of the year (when Fed Chair Powell made his U-turn on policy), while trade war tensions have continued to escalate posing greater risks to the economic outlook.

Subsequently, yesterday’s statement by Fed Vice Chair Clarida may be the first notable sign that the Fed could mull an interest rate cut in the near term having noted that “the Fed are attuned to potential economic risks that could call for more accommodative policy”. Consequently, as rate cut bet continue to rise, upside risks to gold prices may indeed persist, particularly as US yields post fresh multi-year lows.

GOLD PRICE CHART: Daily Time-Frame (Oct 2018-May 2019)

What You Need to Know About the Gold Market

GOLD TRADING RESOURCES:

- See our quarterly gold forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX