Sterling (GBP) Week Ahead – Data and Drivers

- Will BoE shift pace after the latest UK inflation readings?

- ECB and Fed minutes to provide more market color

- Brexit Party storming ahead in European Election polls.

Q2 2019 GBP and USD Forecasts andTop Trading Opportunities

Sterling (GBP) Eyes UK Inflation Data and Latest Brexit News

A busy week for UK asset markets with a variety of heavyweight data and releases to keep traders interested. Later today BoE deputy governor Bill Broadbent will speak at the Imperial College Business School – with the speech released on the BoE website – before BoE governor Carney and MPC members Broadbent, Tenreyro and Saunders appear before the Treasury Select Committee to answer questions about the May inflation report on Tuesday morning. There are also a raft of ECB and Fed speakers throughout the week with Fed Chair Powell starting the ball rolling later today.

The latest UK inflation figures are scheduled to be released on Wednesday at 08:30 GMT and are likely to show price pressures increasing, which in conjunction with the latest jobs report may see markets begin to price in a UK rate hike in November. Recent data supports these calls but as always, Brexit news and negotiations will hold sway. The recently formed Brexit Party is likely to trounce both the Conservatives and Labour at this European Elections – May 23-26 – heaping more pressure on UK PM Theresa May.

GBPUSD Price Rattled by Heightened Brexit Fears, European Elections Near

On Wednesday the latest FOMC minutes are released, while on Thursday the latest ECB minutes will be released. Both are notable events and their interpretation can move markets. The week ends with the latest look at US durable goods orders at 12:30 GMT.

For a comprehensive guide to all this week’s data and events, you can see the DailyFX Economic Calendar

here.

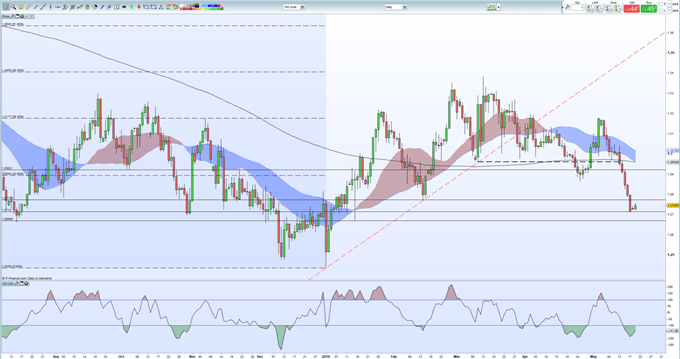

GBPUSD starts the week off its recent low but the move looks unconvincing and is likely to come under pressure as and when Brexit rhetoric ramps up. PM May remains under pressure to break the current gridlock and announce when she is to stand down. Until these two interconnected events happen, any Sterling upside remains capped.

GBPUSD Daily Price Chart (August 2018 – May 20, 2019)

Retail traders are 80.4% net-long GBPUSD according to the latest IG Client Sentiment Data. See how recent daily and weekly positional changes affect GBPUSD and currently give us a stronger bearish contrarian trading bias.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on GBPUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.