Asian Stocks Talking Points:

- Chinese stocks remained pressured, others found reasons to gain

- Sony’s buyback and Microsoft tie-up boosted Japanese equity

- The Dollar also held up well

Find out what retail foreign exchange investors make of your favorite currency’s chances right now at the DailyFX Sentiment Page

Mainland Chinese and Hong Kong stock markets limped into week’s end still weighed down by trade war concerns however other Asian bourses made gains. The Nikkei 225 was buoyed up by a 10% surge for heavyweight Sony whose share buyback and new partnership with Microsoft pleased the crowds.

Earnings from Cisco and Walmart out of the US earlier also smoothed over some trade fears.

An executive order from the Trump administration aimed at banning China’s Huawei from US communication and other digital networks took effect on Thursday. China has vowed to retaliate but a lack of solid news on this front gave some local equity stories a chance to grab investor attentions.

The Nikkei 225 added 1.2% while Australia’s ASX 200 was up by 0.6%. Shanghai was down 1.4% while the Hang Seng shed 0.8%.

The US Dollar held near two-week highs against its major traded rivals, buoyed up by rising Treasury yields, those strong corporate numbers and resilience in the latest housing and labor-market numbers.

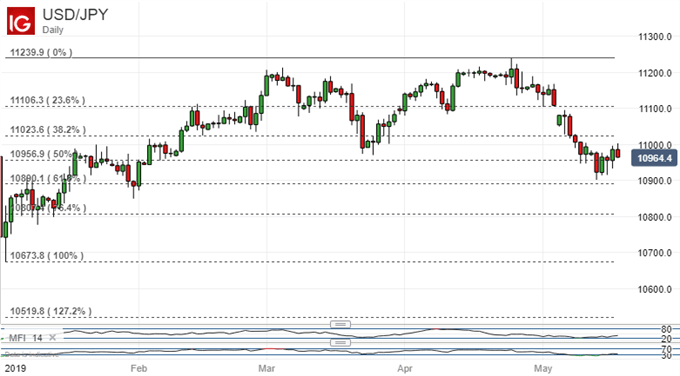

USD/JPY seems to be trying to form some kind of base around the 50% Fibonacci retracement of this year’s gains, at 109.57. However risk appetite is extremely changeable and it is probably far too soon to call any sort of of bottom on the most recent downmove.

Friday’s remaining economic data schedule is extremely lightly populated with only the venerable consumer sentiment snapshot from the University of Michigan likely to rate more than a passing glamce.

Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!